U.S. Senator Elizabeth Warren is pushing back hard on Meta’s (META) ambitions in the stablecoin space. Meta, the tech giant once behind the controversial Libra project, is reportedly eyeing a return to stablecoin territory, and Warren isn’t having it. She is demanding that the Senate’s GENIUS Act, which seeks to regulate stablecoins like Tether’s USDT (USDT-USD) and Circle’s USDC (USDC-USD), be amended to prevent big corporations from creating their own digital currencies. According to Warren, this would stop companies like Meta from gaining control over U.S. financial transactions, potentially shutting out small businesses and political opponents in the process.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Warren told CoinDesk that “No Senator should vote to make it easier for Big Tech to pry into our financial transactions.” Her stance highlights the increasing tension between big tech and lawmakers over the growing influence of companies like Meta on the financial system. While Meta’s push to dominate in the stablecoin sector is nothing new, it seems that the company’s previous attempt at launching Libra (which was later rebranded as Diem) still looms large, with many questioning if this is just a new strategy to reclaim its dominance.

Meta Faces Major Regulatory Scrutiny

Despite Meta’s communication director Andy Stone stating that Diem is “dead,” it’s clear that the company has not given up on its ambitions. The GENIUS Act, now facing uncertainty, holds the key to limiting big tech’s involvement in stablecoins. Senate negotiations are intensifying, and the outcome of this legislation will directly impact how companies like Meta can engage with the future of digital currencies. Warren’s comments also come amid broader scrutiny over Meta’s business dealings, particularly with its financial ties to the Trump administration.

Binance Gets Scrutiny in Parallel

Warren isn’t stopping with Meta. Alongside her campaign against Meta’s crypto ambitions, she has raised alarms about Binance’s deepening ties with the U.S. government, especially concerning its partnership with World Liberty Financial, a crypto firm linked to President Donald Trump. Warren and other Democratic senators are questioning whether Binance’s attempt to roll back its previous legal constraints could pose a threat to financial oversight.

Meta’s Crypto Moves Spark Political Backlash

The debate about Meta’s potential stablecoin revival is about more than just tech and finance—it’s a political battle. Lawmakers are deciding how much control corporations should have over digital currencies. If Meta succeeds, the company could gain unprecedented influence in both the crypto world and the broader U.S. financial landscape.

Senator Warren is pushing hard to limit big tech’s influence over digital currencies. Her effort could significantly alter how stablecoins are regulated in the U.S. If her push succeeds, it would set clear boundaries on corporate control of the crypto space. For now, Meta must wait as lawmakers decide the direction of stablecoin regulations, a decision that could have lasting consequences for the future of digital money.

Is META a Good Stock to Buy Now?

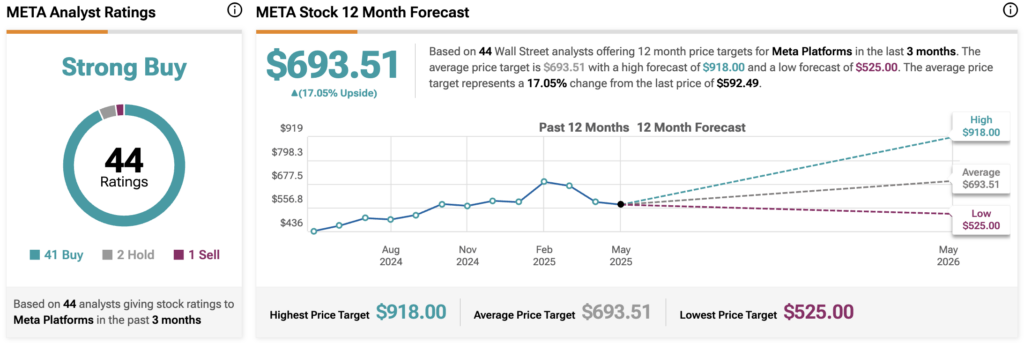

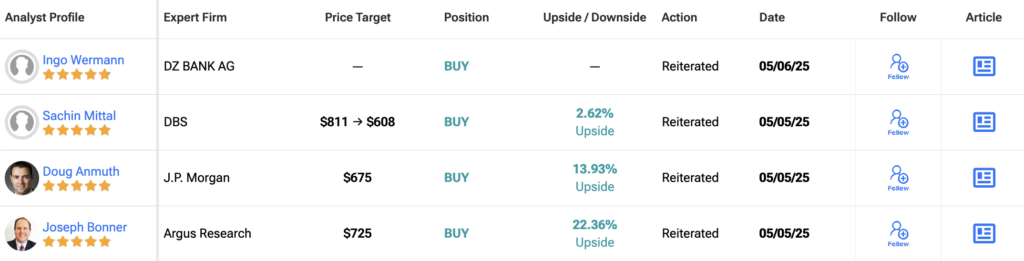

Despite facing regulatory challenges and concerns over its involvement in stablecoins, Meta remains a strong contender in the tech sector. The company’s stock continues to capture significant analyst interest, boasting a Strong Buy consensus rating based on 44 ratings. Of these, 41 analysts have issued a Buy rating, while two analysts have given it a Hold, and only one analyst has rated it as a Sell.

The average 12-month META price target stands at $693.51, which points to a 17.05% upside from its current price of $592.49. What stands out is the high-end target of $918.00. This signals substantial room for growth in the near future. Even with the lowest price target at $525.00, Meta still presents a solid upside.