JPMorgan Chase (JPM) CEO Jamie Dimon says that a U.S. recession this year is still a very real possibility, even after the recent pullback on tariffs with key trading partner China.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

“I wouldn’t take it off the table at this point,” said Dimon when asked about a potential U.S. recession during an interview with Bloomberg News. “If there’s a recession, I don’t know how big it will be or how long it will last,” he added.

When pressed, the CEO said that the economists at JPMorgan put the odds of a recession this year at “close to a toss-up.” Michael Feroli, the lender’s chief U.S. economist, said in a note to clients on May 13 that the recession outlook is “still elevated, but now below 50%.”

Tariff Impacts

Dimon’s comments come less than a week after the U.S. and China announced that they were sharply reducing tariffs on one another for 90 days. The U.S. has also implemented a 90-day pause for many tariffs imposed on other nations.

In a wide ranging interview, Dimon also said there is still “uncertainty” on the tariff front but the pauses are a positive for the economy and stock market. “I think the right thing to do is to back off some of that stuff and engage in conversation,” said Dimon, who has led JPMorgan Chase, the world’s biggest bank, since 2006.

JPM stock has gained 12% this year.

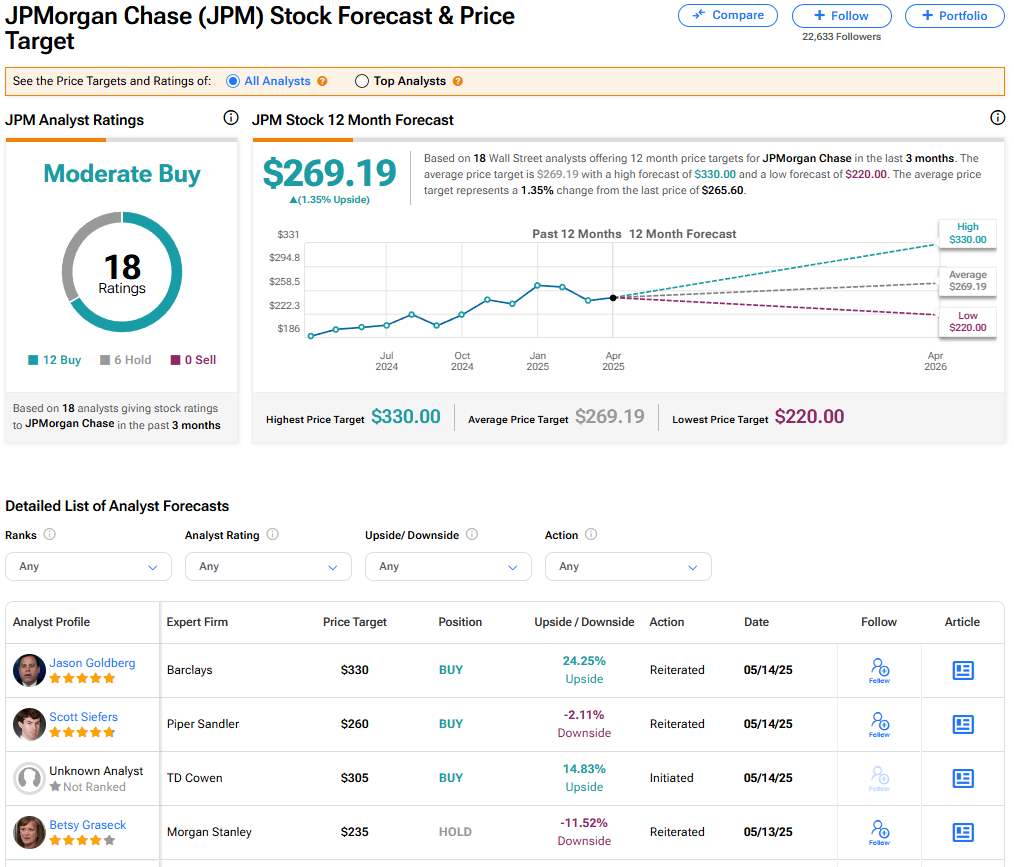

Is JPM Stock a Buy?

The stock of JPMorgan Chase has a consensus Moderate Buy rating among 18 Wall Street analysts. That rating is based on 12 Buy and six Hold recommendations issued in the last three months. The average JPM price target of $269.19 implies 1.35% upside from current levels.