The United States and China reached a short-term trade truce at the Asia-Pacific Economic Cooperation summit in South Korea. The deal paused China’s new export limits on rare earth minerals, which are used in electric cars, phones, and defense systems. In return, the U.S. agreed to ease some tariffs, and China resumed large agricultural imports, including soybeans.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, Treasury Secretary Scott Bessent stated that the U.S. will not remain dependent on China for long. He said that China “made a real mistake” by trying to use export rules as leverage. According to Bessent, the U.S. can break China’s control of the rare earth supply chain within two years.

Building a Local Supply Chain

China currently produces about 70% of the world’s rare earth materials and refines about 90% of them. The U.S. has one major rare earth mine, the Mountain Pass site in California, run by MP Materials (MP). It produces about 45,000 tons a year, compared to China’s quota of 270,000 tons. The U.S. government is now investing heavily to close that gap.

Since 2020, the Department of Defense has spent more than $439 million to build local processing and refining plants. Most of this funding went to MP Materials and Lynas USA, a unit of Lynas Rare Earths (AU:LYC), which operates in Texas. These projects aim to create a full domestic chain from mining to refining.

A Temporary Truce, but a Long-Term Goal

The trade deal allows China to keep exporting key minerals like gallium, graphite, and germanium without new restrictions for one year. It also reduces U.S. tariffs on certain goods linked to fentanyl production from 20% to 10%. While this pause eases tension, it also gives Washington time to expand its own capacity.

If the U.S. meets Bessent’s two-year goal, it would mark a major shift in global supply for critical materials. Investors are now watching companies like MP Materials and Lynas Rare Earths, which could gain from new government contracts and growing demand.

In the meantime, the temporary truce offers some calm for global trade. Yet both sides appear to be preparing for a future where each country controls more of its own supply chain.

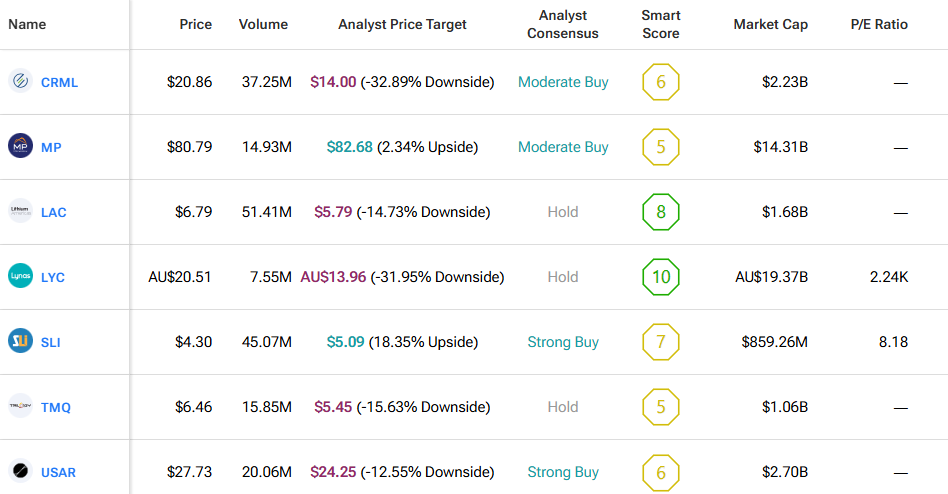

By using TipRanks’ Comparison Tool, we’ve lined up all the companies affected by this development to make it easy for investors to review each stock and see how they stack up across the mineral and technological sectors.