The government of U.S. President Donald Trump has eased restrictions placed on the export of Nvidia’s (NVDA) H200 microchips to China.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Multiple media reports say that the Trump administration is implementing a rule that will enable shipments of Nvidia’s advanced AI chips to China to restart. However, some conditions remain on the export of Nvidia processors to China.

Before any H200 chips can be sent to China, the U.S. Commerce Department requires that the shipments undergo review by a third-party testing laboratory to confirm their artificial intelligence (AI) capabilities. Also, Nvidia must certify that there are sufficient H200 chips available in the U.S. before any can be shipped to China.

The Impact of China on Nvidia

The regulatory change and clearance for Nvidia to start shipping its H200 microchips to China is the latest twist in the ongoing drama involving trade between Washington, D.C. and Beijing. U.S. policy regarding the export of advanced semiconductor technology to China has shifted several times in recent years.

At various times, Nvidia has been banned from shipping microchips to China that can be used for AI models and applications, with the U.S. government citing national security concerns. However, the Trump administration has sought to allow Nvidia to sell the H200 chip to China that is based on older and less powerful technology.

At the same time, China has alternately allowed and threatened to ban the purchase of Nvidia’s processors within the Asian nation. For its part, Nvidia has repeatedly said that China remains an important and potentially lucrative market for the company.

Is NVDA Stock a Buy?

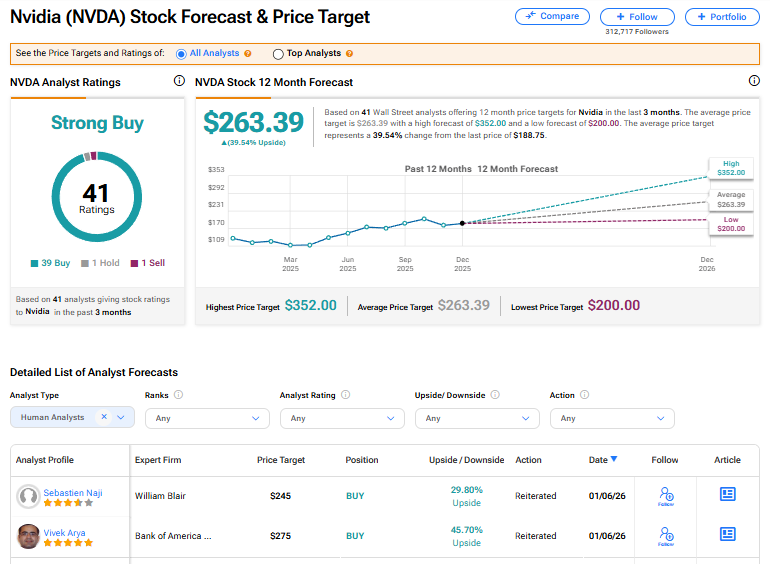

The stock of Nvidia has a consensus Strong Buy rating among 41 Wall Street analysts. That rating is based on 39 Buy, one Hold, and one Sell recommendations issued in the past three months. The average NVDA price target of $263.39 implies 39.54% upside from current levels.