Consumer finance group Synchrony Financial (SYF) said American households are starting to tighten their belts on a darkening economic outlook just as a survey showed a gauge of U.S. consumer confidence sinking to a 12-year low.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Conference Board’s headline consumer confidence measure fell 7.2 points 92.9 in March, the weakest reading since early 2021. But consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low, the CB reported Tuesday.

The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—dropped 9.6 points to 65.2, the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead.

“Meanwhile, consumers’ optimism about future income—which had held up quite strongly in the past few months—largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations,” said CB senior economist Stephanie Guichard.

SYF Sees Consumers Rein in Spend

Max Axler, chief credit officer at branded credit card provider Synchrony, told Reuters that purchase volumes have gone down as consumers across all income groups become more considered about spending. He said they were largely keeping up with repayments, though recent Federal Reserve data indicated delinquencies ticking up for auto loans, credit cards and home credit lines.

It comes after a slew of warnings from retail stocks including Walmart (WMT), Target (TGT) and Home Depot (HD) about the state of the American consumer. Shares of all three fell Tuesday in the wake of the CB data, as it added to growing fears about consumer sentiment in the U.S.

Synchrony, which issues credit cards in partnership with retailers including Walmart’s Sam’s Club and Lowe’s (LOW), has about 100 million consumer accounts, giving it deep insight into the market. Concerns about household finances have weighed on a number of consumer finance stocks, with American Express (AXP) and Synchrony both dipping about 20% from their recent highs, before rallying a touch in recent days.

One of the reasons for the gloomy outlook is the expectation of higher inflation. The CB data showed average 12-month inflation expectations rose again—from 5.8% in February to 6.2% in March—as consumers remained concerned about high prices for household staples and the impact of tariffs.

Is SYF a Good Stock to Buy?

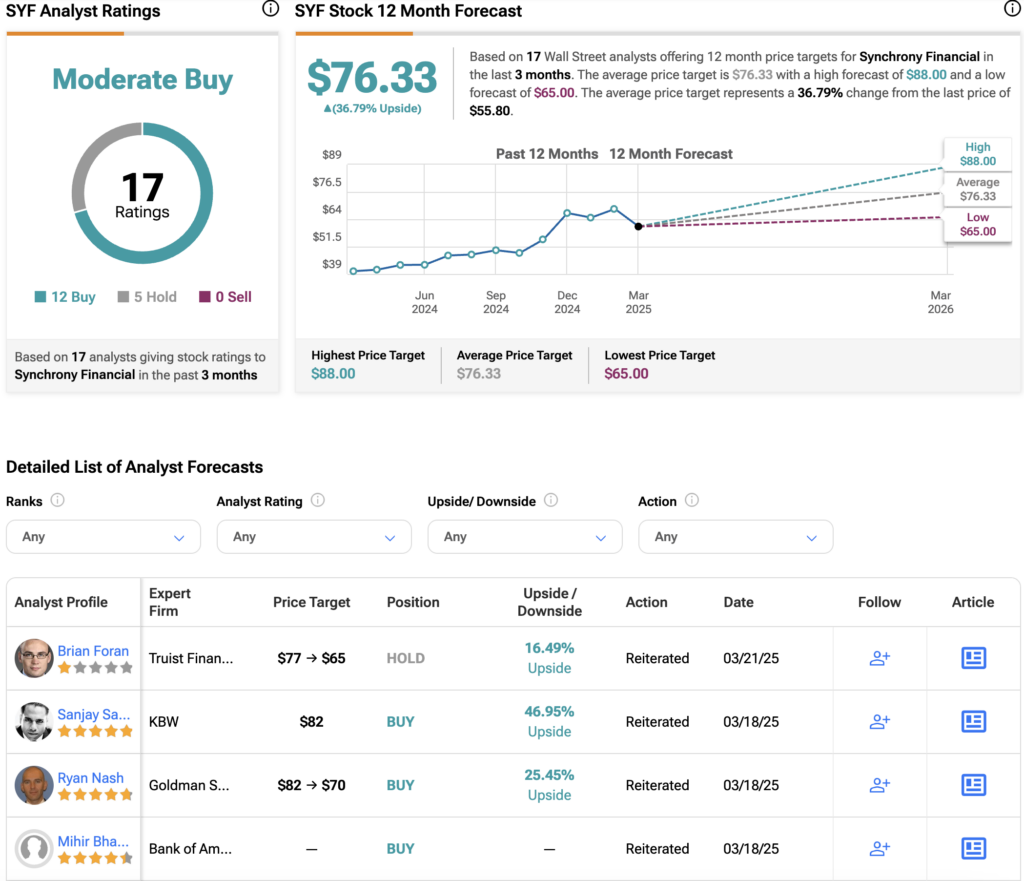

On Wall Street, SYF has a Moderate Buy rating based on 12 Buys, five Holds and no Sells. The average SYF price target of $76.33 implies about 36% upside.