The U.K.’s financial watchdog has set out plans to ban people from borrowing cash to invest in cryptocurrencies such as Bitcoin (BTC).

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

All About Protection

The Financial Conduct Authority (FCA) intends to introduce the restrictions on lending for crypto purchases to retail investors for their “protection.” This includes restrictions on the use of credit cards due to concerns over problems with debt if the value of the crypto asset drops.

The FCA also intends to block retail investors from accessing specialist crypto lenders and borrowers.

“Crypto is an area of potential growth for the U.K. but it has to be done right,” David Geale, FCA executive director of payments and digital finance, told the Financial Times. “To do that we have to provide an appropriate level of protection.”

According to the FT, the proportion of people in the U.K. funding crypto purchases by borrowing has more than doubled from 6% in 2022 to 14% in 2024. Overall, around 12% of U.K. adults now own or have owned crypto, up from just 4% in 2021.

Regulating Crypto

It’s part of a sweep of proposals from the FCA to bring the cryptocurrency market under its regulatory remit. That includes trading platforms, intermediaries, crypto asset lenders and borrowers.

An example will be requiring crypto trading platforms to separate their own proprietary trading activities from those done for retail investors and to provide transparency on pricing and execution of trades. It will also require all companies offering crypto trading to U.K. consumers to operate through an authorised legal entity in the country.

The price of Bitcoin was higher in early trading but blockchain network Ethereum (ETH) was down around 0.2%.

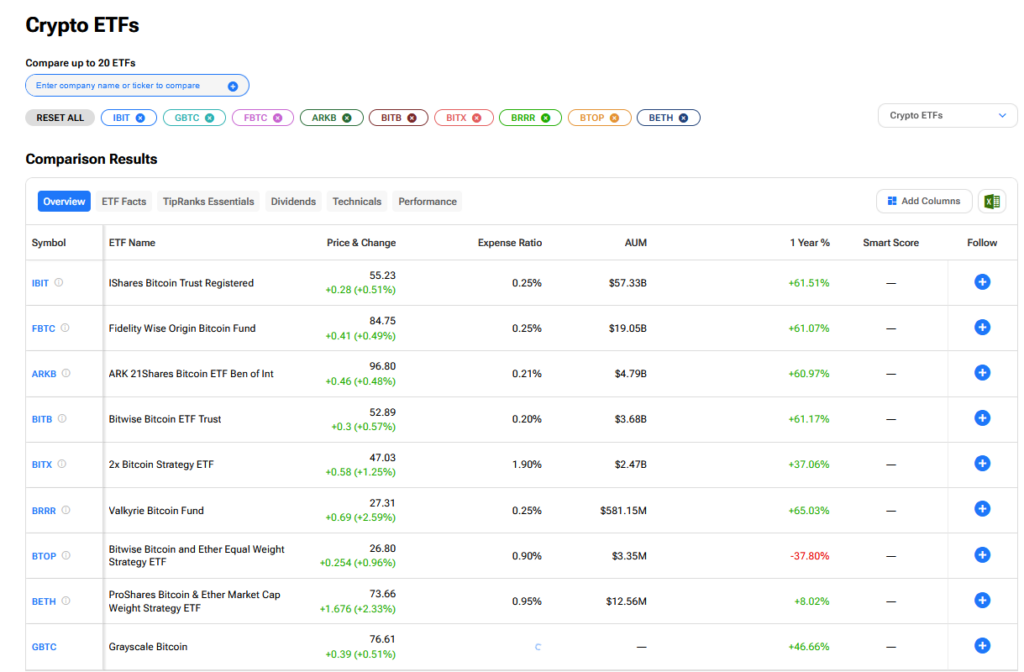

What are the Best Crypto ETFs to Buy Now?

We have rounded up the best crypto ETFs using our TipRanks comparison tool.