Tyson Foods (NYSE:TSN) shares jumped nearly 5% in the early session today after the food products provider posted a resilient performance for the first quarter. With a marginal year-over-year gain of 0.4%, revenue of $13.32 billion landed largely in line with estimates. EPS of $0.60 outpaced expectations by a healthy margin of $0.19.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In Q1, sales in the Beef segment trended higher on the back of higher pricing. On the other hand, a combination of lower volumes and pricing impacted sales in the Chicken segment. Pork sales remained largely unchanged as higher volumes were offset by a decrease in pricing.

For Fiscal Year 2024, Tyson Foods expects relatively flat sales growth. Capital expenditures are seen hovering between $1 billion and $1.5 billion. The company also anticipates an adjusted effective tax rate in the range of 23% to 24% for the year.

What Is the Price Target for TSN?

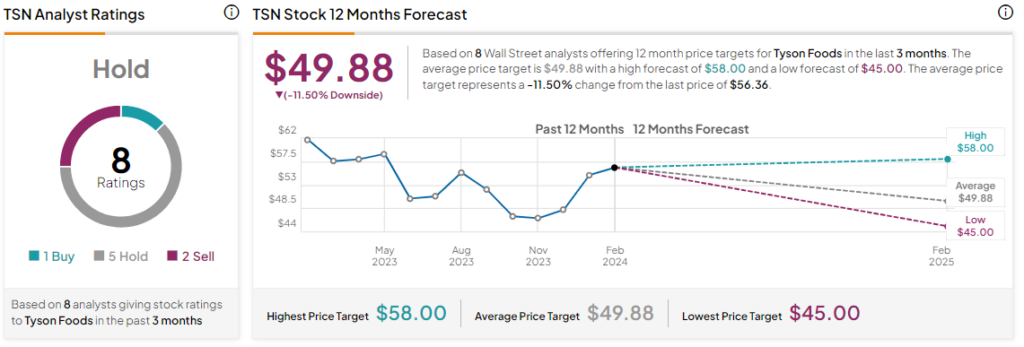

Overall, the Street has a Hold consensus rating on Tyson Foods and the average TSN price target of $49.88 implies a potential downside of 11.5% in the stock. That’s on top of a nearly 13% decline in the company’s share price over the past year.

Read full Disclosure