Shares of the semiconductor company Texas Instruments, or TI (TXN), gained about 3% in Tuesday’s after-hours trading session. The increase came after the company reported better-than-anticipated numbers for the second quarter.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

TXN’s Q2 Results

Texas Instruments reported Q2 earnings of $1.22 per share, which surpassed the Street’s expectations of $1.16 but decreased 35% year-over-year.

Meanwhile, the company posted revenues of $3.82 billion, down 16% year-over-year. However, its revenues exceeded the Street’s estimate of $3.80 billion. The year-over-year decline was due to the weakness in its end markets, primarily in the industrial and automotive segments.

Looking forward, management now expects revenue and adjusted earnings per share for Q3 2024 to be in the ranges of $3.94 billion and $4.26 billion and 1.24 to $1.48 per share, respectively.

Is Texas Instruments a Buy, Sell, or Hold?

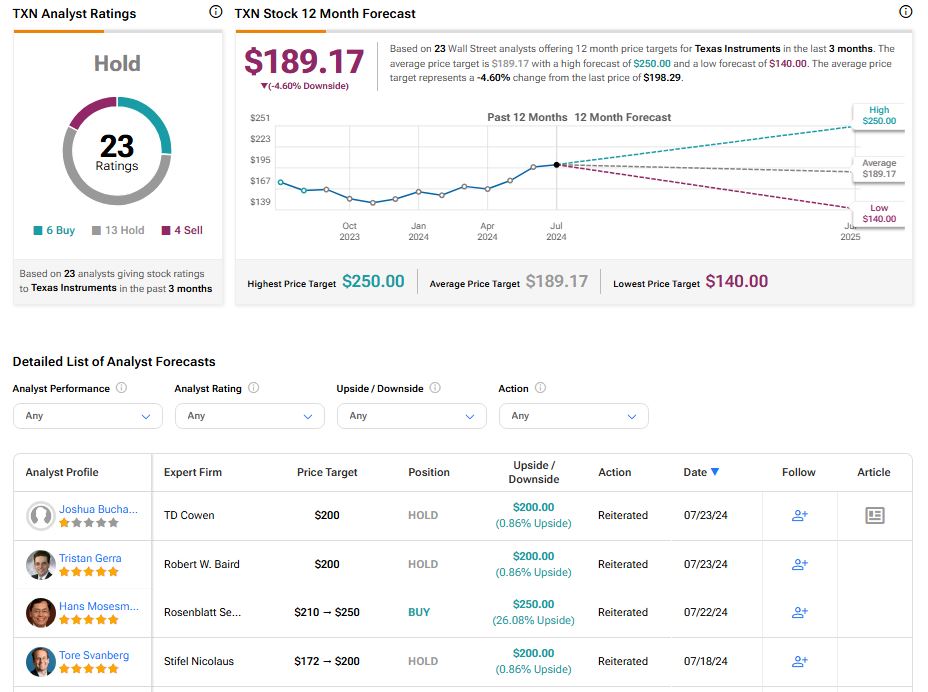

TXN’s share price has rallied by nearly 11% over the past year. Overall, the Street has a Hold consensus rating on the stock, alongside an average TXN price target of $189.17. However, analysts’ views on TXN could see changes following today’s earnings report.