BioCryst Pharmaceuticals (BCRX), a biotech that creates unique therapeutics for rare conditions, has reported impressive growth metrics and surpassed top-and-bottom-line expectations, taking the company to new highs. It has done so thanks to its two key products; ORLADEYO, a treatment for hereditary angioedema, and RAPIVAB, an antiviral influenza treatment. Also bolstering its prospects, BioCryst is preparing to widen ORLADEYO’s application to pediatric patients, and the company is innovating new pipeline candidates for conditions like Netherton syndrome and diabetic macular edema.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The stock is up 26.5% year-to-date, and management has elevated its 2024 revenue forecast, suggesting further upside potential. The stock may appeal to investors looking for biotech trading at a reasonable price with upside growth potential.

BioCryst Marketable Treatments Gain Traction

BioCryst Pharmaceuticals is a biotech firm developing oral therapies for rare diseases. The company has reported notable success with ORLADEYO (berotralstat), its once-daily treatment for preventing Hereditary Angioedema (HAE) attacks. The drug has recently received approvals and reimbursement authorizations in Europe and Latin America.

Its other marketed treatment has also seen recent success, with the U.S. Department of Health and Human Services awarding BioCryst a $69 million contract for procuring up to 95,625 doses of RAPIVAB (peramivir injection) for influenza treatment over five years.

BioCryst is advancing other rare disease candidates through its clinical pipeline. In 2025, it plans to submit a regulatory filing to expand ORLADEYO’s label to include a granule formulation for children aged two and up. In addition, BCRX has established collaborations and licensing relationships with several organizations, including Torii Pharmaceutical (TRXPF), Seqirus UK, Shionogi & Co., Green Cross Corporation, and prominent health and academic institutions.

BioCryst’s Recent Financial Results & Outlook

The company recently announced results for the second quarter of 2024. Revenues rose 32.5% year-over-year to $109.3 million from the previous year’s $82.5 million. This notable increase is primarily attributed to the net revenue generated from ORLADEYO, which soared by 33.7% to $108.3 million, compared to $81.0 million in the same quarter of the previous year.

Simultaneously, research and development expenses dropped by 26.6% due to reduced spending on BCX10013 and the discontinuation of the BCX9930 program. General and administrative expenses, on the other hand, saw a 20.0% year-over-year hike, reaching $61.2 million in Q2 2024, up from $51.0 million in Q2 2023. This surge is mainly due to increased commercial expenses, supporting newly launched regions, expanded international operations, and rising expenses for accounting and IT functions.

Despite the hike in some expenses, total operating expenses dropped by 2.5% year-over-year to $100.6 million. The net loss for the second quarter of 2024 was $12.7 million, or -$0.06 per share, compared to a net loss of $75.3 million, or -$0.40 per share, for the second quarter of 2023.

At the end of the quarter, cash, cash equivalents, restricted cash, and investments stood at $338.1 million.

Following the promising results for the second quarter, BCRX’s management has upped its guidance for 2024, projecting ORLADEYO revenue of $420 million to $435 million, a rise from the previous range of $390 to $400 million. Despite this, the operating expense outlook remains constant at $365 to $375 million. The firm plans to be profitable by 2024, expecting positive earnings per share and positive cash flow towards the latter half of 2025 and achieving these goals by 2026.

The company also anticipates meeting these financial targets without extra fundraising and does not anticipate the need to draw upon the additional $150 million debt available from Pharmakon.

What Is the Price Target for BCRX Stock?

The stock had been on a downward trend for much of 2023 and well into this year. However, the successful launch of ORLADEYO helped spark a rally in the shares beginning in May, helping to drive the shares up roughly 60% in the six months since. It trades near the high end of its 52-week price range of $4.03 – $8.88. Yet, despite the run-up in price, the stock still trades at a relative discount, with its P/S ratio of 3.9x, sitting well below the Biotechnology industry average of 9.6x.

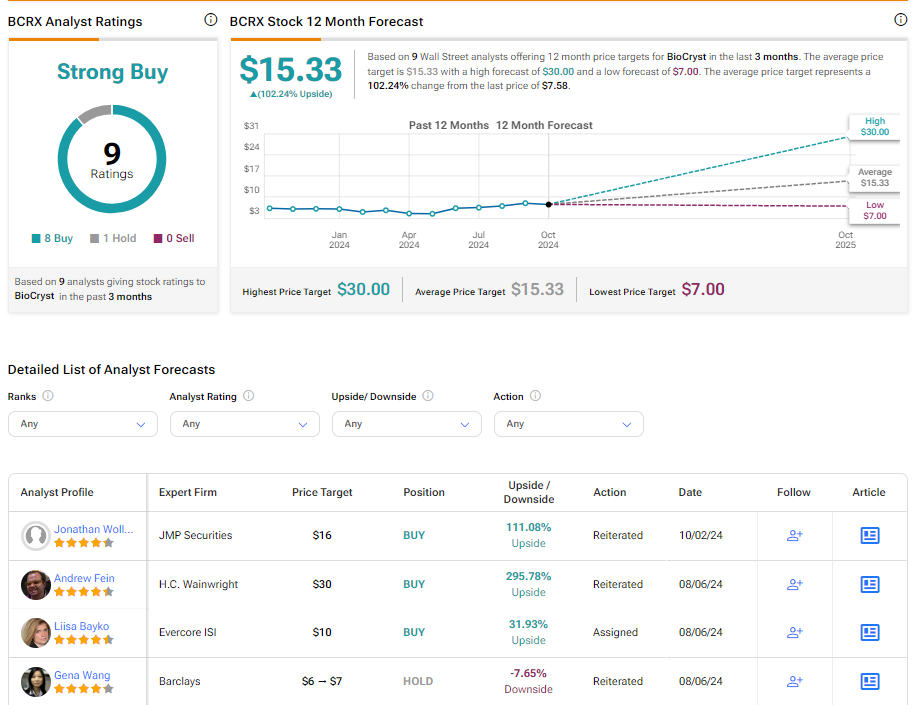

Analysts following the company have been bullish on BCRX stock. Based on nine analysts’ cumulative recommendations, BioCryst is rated a Strong Buy. The average price target for BCRX stock is $15.33, representing a potential upside of 102.24% from current levels.

Bottom Line on BioCryst

BioCryst continues to impress with its successful commercialization of ORLADEYO and RAPIVAB, catapulting its Q2 2024 revenue and earnings beyond expectations. With the ambition to expand ORLADEYO’s application to children and new candidates in the pipeline, the company’s growth trajectory shows immense potential.

The company’s management is optimistic, raising its 2024 revenue forecast and fueling predictions of further upside. The stock has surged recently yet still trades at an appealing price point, making it an intriguing opportunity for investors looking for upside potential in the biotech market.