Shares of video game maker Take-Two Interactive (NASDAQ:TTWO) fell in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2024. GAAP earnings per share came in at -$17.02, which may not be comparable to analysts’ consensus estimate of $0.09 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In addition, sales decreased by 3.4% year-over-year, with revenue hitting $1.4 billion. Nonetheless, this beat analysts’ expectations of $1.32 billion. Looking forward, management now expects revenue and earnings per share for Fiscal Year 2025 to be in the ranges of $5.57 billion to $5.67 billion and -$3.90 to -$3.50, respectively. For reference, analysts were expecting $5.3 billion in revenue.

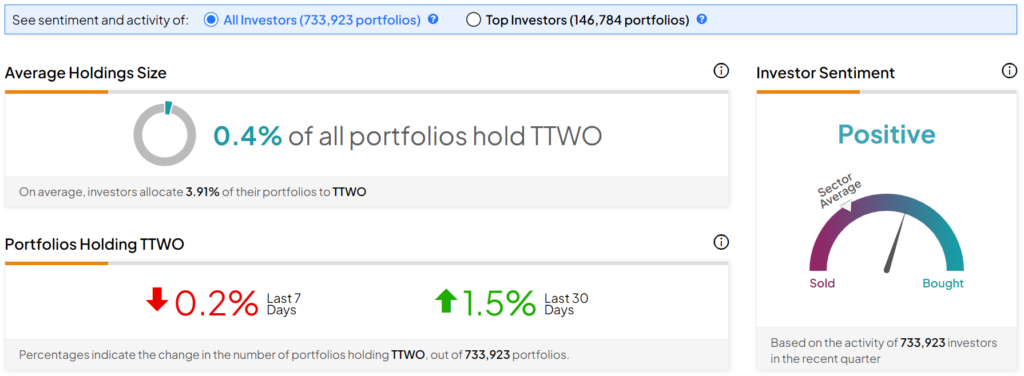

Investor Sentiment for TTWO Stock Is Currently Positive

The sentiment among TipRanks investors is currently Positive. Out of the 733,923 portfolios tracked by TipRanks, 0.4% hold TTWO stock. In addition, the average portfolio weighting allocated towards TTWO among those who do have a position is 3.91%. This suggests that investors in the company are fairly confident about its future.

Furthermore, in the last 30 days, 1.5% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

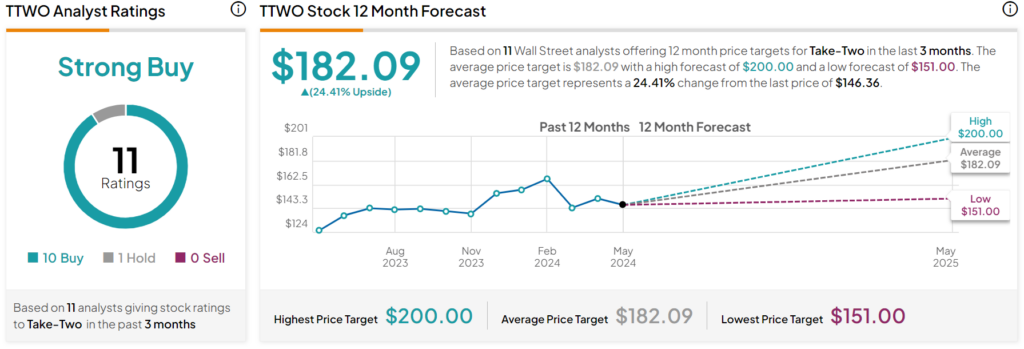

Is TTWO Stock a Buy Right Now?

TTWO stock has a Strong Buy consensus rating based on 10 Buys, one Hold, and zero Sells assigned in the past three months. After a 17% rally in its share price over the past year, the average TTWO stock price target of $182.09 per share implies 24.41% upside potential. However, this might change following today’s earnings report.