Five-star-rated analyst Mark Mahaney at Evercore ISI has downgraded his rating from Buy to Hold on The Trade Desk (TTD) after the company reported mixed results for 2024. Mahaney also trimmed the price target from $135 to $90, now predicting a downside of 26.4%. Meanwhile, TTD stock slumped around 28% in pre-market trading on Thursday.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

What Led Evercore to Downgrade TTD Stock?

Evercore noted that The Trade Desk missed its internal guidance for the first time in over eight years, signaling potential issues. Notably, The Trade Desk reported Q4 revenue of $741 million, missing both the analyst consensus of $758 million and the company’s guidance of at least $756 million.

Mahaney further stated that the company’s revenue growth shifts from premium to sub-premium, likely due to several core factors. This shift is expected to have major implications for the company’s valuation, with Evercore projecting that Trade Desk will lose its “super-premium” stock multiple.

Additionally, Evercore believes that moving forward, the stock will likely remain within a trading range, offering limited upside.

More Analysts Chop Price Targets on TTD Stock

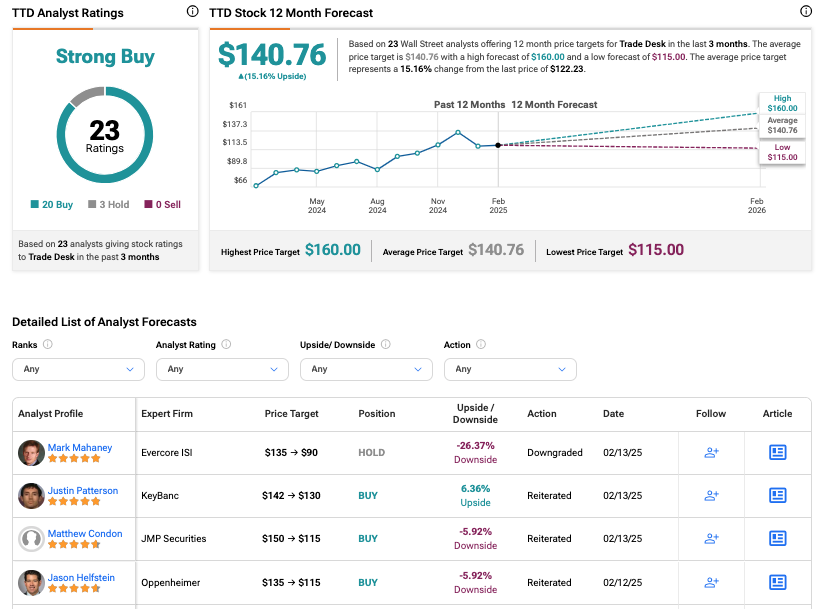

Apart from Evercore, analysts from KeyBanc, JMP Securities, and Oppenheimer have chopped their price targets on TTD stock but have maintained their Buy ratings.

Oppenheimer analyst Jason Helfstein also linked the price target cut to a revenue shortfall in Q4, which he attributed to the slower-than-expected adoption of the next-gen Kokai platform. Nevertheless, he reaffirmed that the company’s long-term investment outlook remains unchanged. Helfstein reduced his price target from $135 to $115, forecasting a 6% decline in the stock.

Is Trade Desk a Good Stock to Buy?

TTD stock has a consensus Strong Buy rating among 23 Wall Street analysts. That rating is based on 20 Buy and three Hold recommendations issued in the last three months. The average TTD price target of $140.76 implies a 15.16% upside from current levels.