TSMC (TSM) saw its revenue surge by 33% in August to NT$250.87 billion ($7.8 billion). This was a promising indicator for investors anticipating a rebound in the smartphone market and continued strong demand for Nvidia’s (NVDA) AI chips. Notably, TSMC is a key chip supplier for both Nvidia and Apple (AAPL).

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Despite this surge, TSMC’s August sales of NT$250.87 billion decreased slightly by 2.4% from the previous month’s impressive 45% growth. Looking ahead, according to a Bloomberg report, analysts predict TSMC’s revenue will increase by 37% for the third quarter, continuing its recovery from the post-pandemic lows of 2023.

Why Is TSM’s Monthly Data Important?

While this data reflects just one month, it may help ease investors’ concerns about whether there is a slowdown in spending on AI infrastructure. Monthly figures like these provide a snapshot that could indicate longer-term trends.

Adding to this perspective, a Bloomberg report, citing Bernstein analyst Mark Li, noted that TSMC is on track to exceed average third-quarter revenue forecasts. Li explained, “If September follows the average seasonality of the past 8 years, 3Q24 revenue would come 5 to 6% above both the guidance mid-point & consensus.” Such statements suggest confidence in TSMC’s continued growth trajectory.

It is also important to note that TSMC derives more than half of its revenue from high-performance computing, a key business segment fueled by rising AI demand. This highlights the importance of AI-driven growth for the company’s overall revenue.

Demand for AI Chips Drives TSMC’s Revenues

Furthermore, in its most recent earnings report in July, TSMC delivered an optimistic outlook, raising its full-year growth forecast beyond the mid-20% range it had previously projected. The company is also pursuing a global expansion strategy and plans to start mass production at its Arizona fabrication facility next year.

Additionally, it is contemplating the construction of a third fabrication facility in Japan and has recently broken ground on a €10 billion facility in Germany. Such moves demonstrate TSMC’s commitment to meeting global demand and solidifying its market position.

Is TSM a Buy, Sell, or Hold?

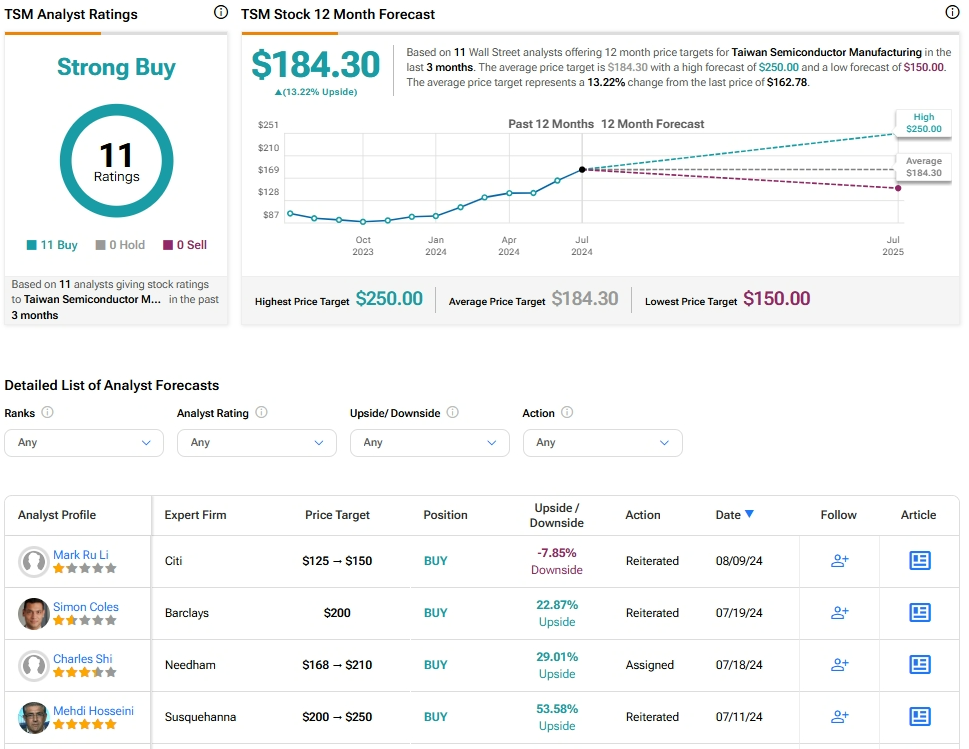

Analysts remain bullish about TSM stock, with a Strong Buy consensus rating based on a unanimous 11 Buys. Over the past year, TSM has surged by more than 80%, and the average TSM price target of $184.30 implies an upside potential of 13.2% from current levels.