TSMC (TSM) stock rallied on Wednesday after the semiconductor company announced that it has started mass production of 2nm chips. This move signals a shift in the industry, as the 2nm chips will succeed the current 3nm chips. They offer more power while also being more energy efficient. As such, they are expected to improve the performance of several devices, such as smartphones and tablets.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

TSMC noted that the mass production of the 2nm chips started at its facilities in Baoshan and Hsinchu, Taiwan. The company intends to expand this production to other facilities over the next year as demand for the chips increases. This includes planned manufacturing factories in other countries, such as the U.S.

TSMC’s mass production announcement is also positive news for several chipmakers. The company has partnerships with major tech companies, including Apple (AAPL), Nvidia (NVDA), Advanced Micro Devices (AMD), Qualcomm (QCOM), and Broadcom (AVGO). Advances at TSMC will benefit these companies as they push for new technology to power artificial intelligence (AI) data centers.

TSMC Stock Movement Today

TSMC stock was up 2.3% on Wednesday, extending a year-to-date 57.09% rally. Trading activity was light at about 1.6 million shares, compared to a three-month daily average of about 10.66 million units.

With no signs of the AI boom slowing, TSM stock could see additional gains in 2026. Investors will want to keep an eye on CES 2026 in early January to see what chipmakers have planned for the year.

Is TSMC Stock a Buy, Sell, or Hold?

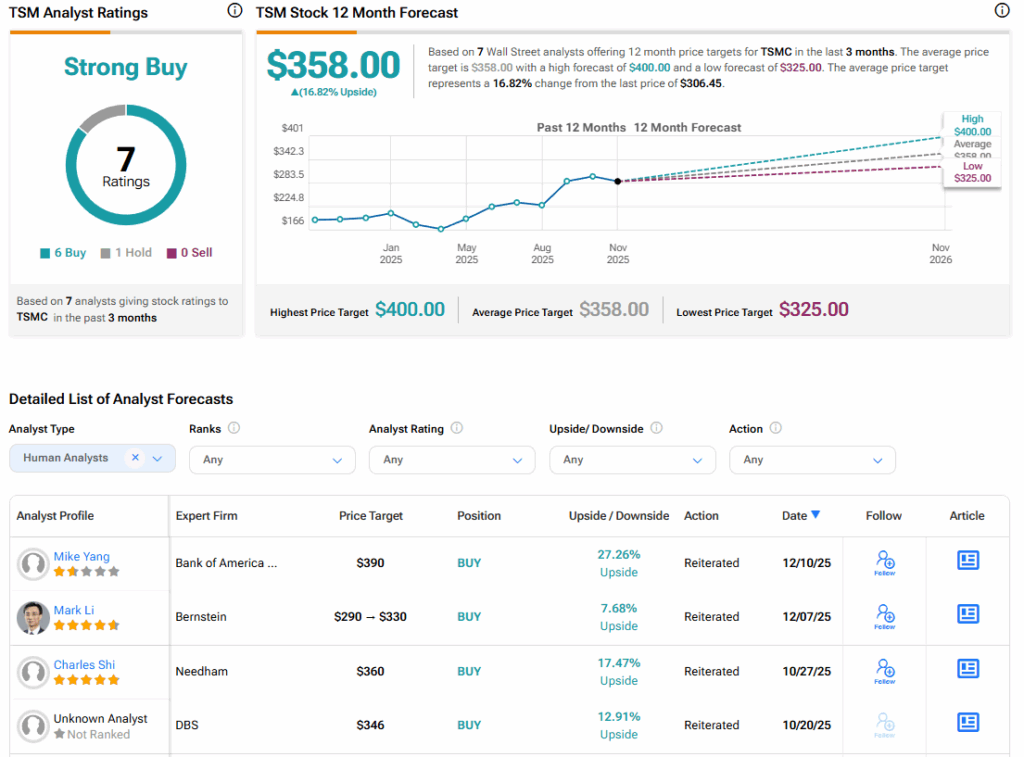

Turning to Wall Street, the analysts’ consensus rating for TSMC is Strong Buy, based on six Buy and a single Sell rating over the past three months. With that comes an average TSM stock price target of $358, representing a potential 16.82% upside for the shares.