TSMC stock (TSM) rose 2.96% to $304.71 on Tuesday and gained another 2.16% in premarket trading, after the chipmaker raised its revenue outlook and reported record third-quarter earnings on booming AI chip demand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TSMC Lifts Revenue Forecast on AI Growth

Taiwan Semiconductor Manufacturing (TSMC) raised its full-year revenue growth forecast to the middle of a 30%–40% range, up from its prior target of 30%, citing continued strength in AI-related chip orders. It also guided fourth-quarter revenue between $32.2 billion and $33.4 billion, supported by demand for advanced process technologies.

The outlook upgrade followed a strong third-quarter report. Net income reached NT$452.30 billion ($14.77 billion), up 39% year over year and ahead of consensus forecasts. Revenue rose 30% in local currency and 41% in U.S. dollars to $33.10 billion, despite currency headwinds.

CEO Dismisses Talk of AI Hype Cycle

TSMC CEO C.C. Wei pushed back against concerns that AI chip demand may be overhyped, saying the company’s long-term view on growth remains intact.

“Our conviction in the megatrend is strengthening and we believe the demand for semiconductors will continue to be very fundamental as a key enabler of AI applications,” Wei said on the company’s earnings call.

TSMC is the main chip foundry for Nvidia’s AI accelerators and also supplies processors to Apple (AAPL), AMD (AMD), and Qualcomm (QCOM), giving it broad exposure across AI, mobile, and computing markets.

Analysts Weigh Bubble Risk

Some analysts have raised questions about circular financing in the AI space, citing examples like Nvidia and OpenAI. However, TSMC’s numbers and raised guidance suggest real demand is driving orders, not hype.

CFO Wendell Huang said business momentum remains strong, citing “continued strong demand for our leading-edge process technologies.”

Is TSM Stock a Good Buy?

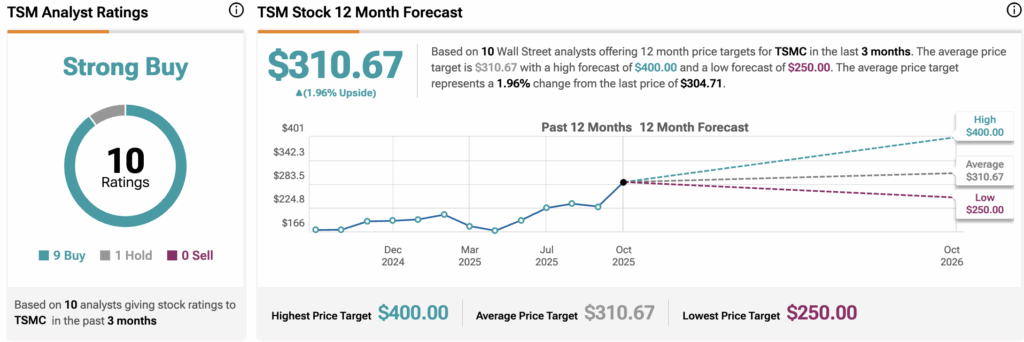

Wall Street analysts remain bullish on TSMC following its earnings and guidance update. Out of 10 analysts tracked in the past three months, nine rate the stock a Buy, and one rates it a Hold. There are no Sell ratings.

The average 12-month price target is $310.67, implying a modest 1.96% upside from Tuesday’s closing price.