Taiwan Semiconductor Manufacturing Company (TSM) and other Asian chip stocks fell on Friday after Nvidia (NVDA) tumbled and U.S. President Donald Trump’s tariff threats weighed on market sentiment. TSM’s Taiwan listing declined 1.89% as Asian technology stocks were battered by the NVDA-led selloff, with the company plunging 8% on Thursday and exiting the $3 trillion club in the process as investors picked apart its quarterly earnings update.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Elsewhere, semiconductor testing equipment supplier Advantest (JP:6857), (ATEYY) fell nearly 9%, while Tokyo Electron (JP:8035), (TOELY) dropped over 5%.

Microcontroller unit specialist Renesas Electronics (JP:6723), (RNECF) fell more than 4% while, Lasertec, (JP:6920), (LSRCF), which makes inspection and measurement systems used primarily in the semiconductor industry, slipped over 7%. More broadly, Japan’s Nikkei declined 2.9%, the Hang Seng fell 3.5% and Taiwan’s stock market dipped 1.5%.

China and Tariff Concerns for TSM

Asian stock markets were broadly weaker after Trump confirmed tariffs on Mexico and Canada would go ahead next week. China, which already has a 10% tariff on imports to the US, “will likewise be charged an additional 10% tariff on that date,” he said.

Last week, the president indicated he would impose additional tariffs on semiconductors of 25% in April, as well as on autos and pharmaceutical imports. TSM, the world’s largest contract chipmaker, seemed to come under particularly attention as Trump accused Taiwan of stealing America’s chipmaking industry. Earlier this month Trump said Taiwan “took our chip business away” and vowed to bring the business “back in the US,”, prompting Taiwan President Lai Ching-te to pledge to increase procurement and investment in the U.S. This prompted scolding by China as tensions around tariffs and a long-running battle for technological supremacy underscored that the stakes are high.

Earlier TSM, which makes most of NVDA’s advanced AI chips, had plunged nearly 7% in New York on Thursday amid reports about TSM producing hundreds of thousands of chips that ended up at China’s Huawei. Jeffrey Kessler, Trump’s nominee for under-secretary of commerce for industry and security, said the reports were a “huge concern.”

Did TSM Chips Go to Huawei?

In October, TechInsights found a TSM chip in Huawei’s 910B AI processor, its most advanced AI accelerator. According to Reuters, TSMC suspended shipments to Chinese chip designer Sophgo, whose chip matched the one in the Huawei 910B and, while the U.S. Commerce Department ordered TSMC to halt shipments of more chips to Chinese customers. Around this time, says media reports suggested Sophgo was ordering hundreds of thousands of chips, says Reuters.

Concerns about advanced AI chips ending up in China are rising, with officials probing whether DeepSeek bought advanced NVDA semiconductors through third parties in Singapore to circumvent U.S. restrictions on the sale of chips, Bloomberg reported last month.

Is TSM a Good Stock to Buy?

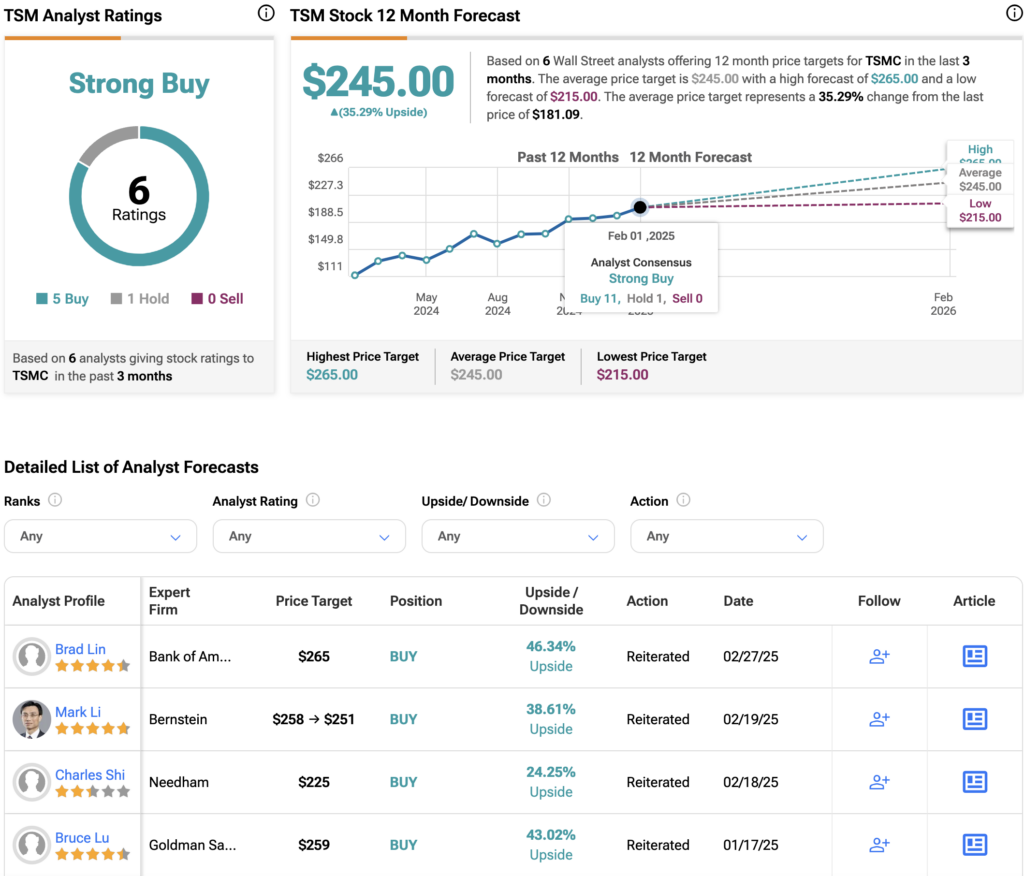

Overall, Wall Street has a Strong Buy consensus rating on TSM stock, based on five Buys and one Hold. The average TSM price target of $245.00 implies around 35% upside.