Taiwan Semiconductor Manufacturing Co. (TSM) has officially kicked off construction on its third chip facility in Arizona, marking a bold step in the company’s multibillion-dollar U.S. expansion. As Washington pushes for semiconductor self-reliance, TSMC’s latest move shows stronger ties to America’s tech goals and a growing local chip supply. TSM stock gained 1.65% in pre-market trading on Wednesday.

TSMC Begins Work on Third Arizona Plant

According to the latest announcement, the new facility is expected to create around 6,000 jobs and will produce advanced semiconductor chips using 2-nanometer or even more cutting-edge technology, with production planned to begin before 2030.

The event was attended by U.S. Secretary of Commerce Howard Lutnick, who praised the expansion as a major step for American manufacturing. He highlighted that the move reflects the Trump administration’s push to bring more factories and jobs back to the U.S.

In March, President Trump praised TSMC, calling it “the most powerful company in the world” after it announced a $100 billion U.S. investment over the next four years. This brings the chipmaker’s total planned investment in the U.S. to $165 billion. Most of the funds are focused on expanding TSMC’s operations in Arizona.

Why It Matters for the U.S

TSMC is the world’s largest semiconductor manufacturer and a key supplier to companies like Apple (AAPL), Intel (INTC), and Nvidia (NVDA).

As Trump pushes for higher tariffs, production costs for overseas-made chips are expected to rise. Nonetheless, TSMC’s growing investment in Arizona marks a significant step toward strengthening the domestic chip supply chain. It not only enhances national security and reduces dependence on foreign production but also positions the U.S. as a leading force in advanced semiconductor manufacturing.

Is TSM a Good Stock to Buy?

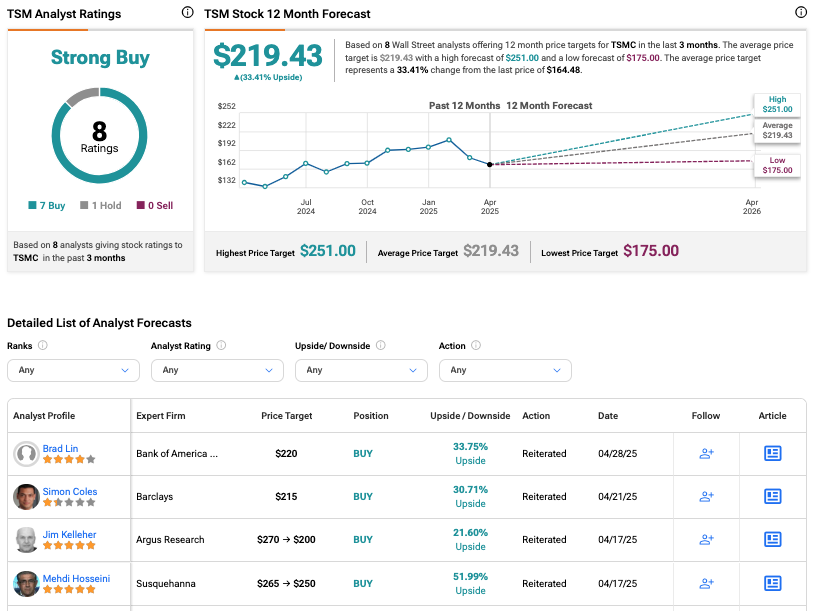

Turning to Wall Street, the analysts’ consensus rating for TSM stock is Strong Buy based on seven Buys and one Hold assigned over the last three months. At $219.43, the average TSMC stock forecast implies an upside of 33.41% from current levels.