While Intel (INTC) is working hard to become a domestic leader in chip making, J.P. Morgan (JPM) believes TSMC (TSM) is still the undisputed king of the industry. The Taiwanese firm has seen its stock value more than triple since late 2023 because it manufactures the world’s most powerful AI processors for companies like Nvidia (NVDA) and AMD (AMD).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Even with Intel launching its new Panther Lake processors this week, analysts argue that the world’s most important tech projects will stay with TSMC for the foreseeable future.

J.P. Morgan Sees No Meaningful Threat From Intel

Gokul Hariharan, an analyst at J.P. Morgan, told investors on Wednesday that Intel still has a long way to go to prove it can handle the most advanced work. He believes that while some companies might give Intel small, experimental projects to satisfy the U.S. government, the mission critical work will remain in Taiwan.

Hariharan wrote in his research note: “We believe that customers are likely to place small volume projects at Intel Foundry given the U.S. government investment, but almost all mission-critical projects in the N2 family are likely to be at TSMC in the next few years.” He added that Intel would likely need to successfully manufacture several generations of chips perfectly before major customers like Nvidia would trust them with their top-tier products.

TSMC Raises Growth Targets as AI Demand Doubles

The financial gap between the two companies continues to widen. TSMC recently told investors it expects its 2025 revenue to grow by as much as 40%. The company anticipates that its revenue from AI-related chips will double this year alone.

To keep up with this insatiable need for power, TSMC is planning to spend between $40 billion and $42 billion on new factories and equipment in 2025. This massive spending ensures that TSMC stays ahead of Intel and Samsung (SSNLF), who are struggling to match TSMC’s high yield rates, which are the percentage of usable chips produced on a single wafer.

Intel Struggles to “Gain Credibility with Fabless Customers”

Intel recently released its Core Ultra Series 3 chips, which are the first to be made using its advanced 18A process in the United States. However, J.P. Morgan argues that this won’t be enough to lure away TSMC’s biggest fans.

“We believe Intel Foundry may need to prove its execution on at least two to three leading-edge process nodes for it to gain credibility with fabless customers,” Hariharan noted. Until Intel can prove it can mass-produce these complex chips without errors, giants like Apple (AAPL) and Broadcom (AVGO) are expected to keep their multi-billion dollar orders at TSMC. To stay competitive, TSMC is also diversifying its own locations, with plans to begin making 2-nanometer chips in Arizona by 2028.

Key Takeaway

TSMC continues to dominate the high-end chip market because its 2-nanometer technology remains far ahead of what competitors can offer. This technological lead ensures that major players like Nvidia and AMD will keep their most important business in Taiwan for the foreseeable future. Despite billions in government support, Intel still faces a steep climb to earn the same level of trust from global tech giants.

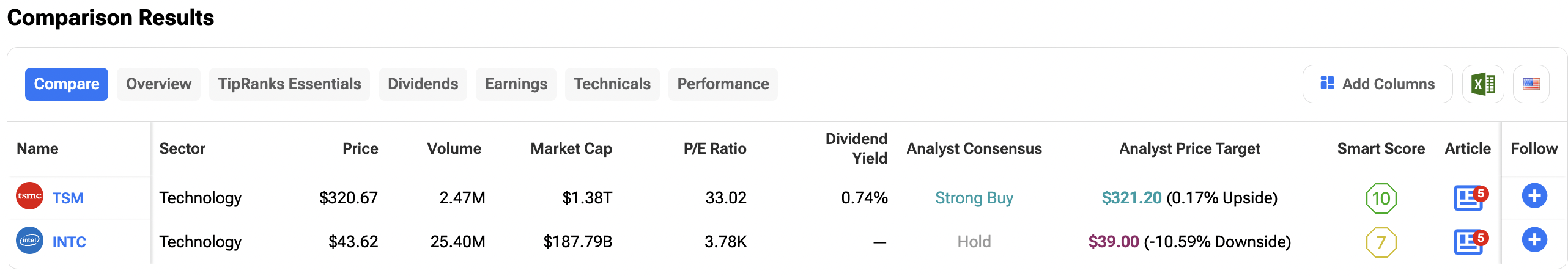

Investors can compare both TSMC and Intel stocks side-by-side on the TipRanks Stocks Comparison Tool. Click on the image below to find out more.