Taiwan Semiconductor (NYSE:TSM), the world’s largest contract chip manufacturer, has benefited from the ongoing recovery of the global chip market in recent months. Although TSM stock is up 58% in the last 12 months, I believe there is more upside potential amid the ongoing rise of AI technology. I am bullish on Taiwan Semiconductor, as I believe the competitive advantages enjoyed by the company will fuel earnings growth in the next few years.

TSM Enjoys Competitive Advantages

The long-term earnings growth potential of a company mostly relies on the nature of competitive advantages enjoyed by that company. Taiwan Semiconductor enjoys such competitive advantages for a few reasons.

First, Taiwan Semiconductor, alongside Samsung (OTC:SSNLF), is a market leader in developing leading-edge process technology, commonly known as nodes. Because of the substantial costs involved in manufacturing these nodes and the complex engineering processes that need to be followed to develop them, smaller companies have found it increasingly difficult to compete with Taiwan and Samsung in this domain.

Taiwan Semiconductor was the first chipmaker to commercialize 5nm chips and is already advancing aggressively to commercialize 3nm and 2nm chips. These smaller nodes, which can offer faster and more efficient performance compared to their larger peers, play a crucial role in the development of AI servers and other high-performance applications.

Beyond just manufacturing high-performance, smaller chips, TSM has expanded its capabilities in the chip packaging solutions domain as well. The company’s novel 3D Fabric technology promises to offer increased performance and density by stacking multiple chip components vertically.

Second, Taiwan Semiconductor has formed strategic partnerships with industry leaders in various tech subsectors, allowing the company to aggressively invest in developing advanced products, given the assurance of a growing sales pipeline. Some of TSM’s noteworthy customers include Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), and Advanced Micro Devices (NASDAQ:AMD).

Third, the company’s Open Innovation Platform (OIP) helps it foster long-term partnerships with customers across the semiconductor value chain, resulting in sticky revenue. This platform allows customers to search for the right intellectual property components and design solutions that match TSM’s manufacturing process. This, in turn, enables customers to bring products to the market seamlessly and faster compared to sourcing IP components from multiple platforms.

IP owners, on the other hand, have historically shown a willingness to join the OIP to expose themselves to potential clients. This has created a flywheel effect, increasing the ecosystem value of this platform. The OIP has played a key role in TSM’s foundry business success in recent times.

Finally, Taiwan Semiconductor maintains a very healthy balance sheet with a net cash position. Its cash balance of $54.97 billion far exceeds its long-term debt of $29.9 billion. The company has maintained a net cash position consistently in the last decade, which is a remarkable achievement, given the cyclicality of the semiconductor industry and the substantial capital investments required to improve manufacturing processes.

This net cash position allows Taiwan Semiconductor to easily fund aggressive capital investments, such as constructing new manufacturing facilities, which are critical to maintaining its technological lead in the chip sector. In addition, the net cash position adds a safety layer to the company’s dividend while opening up new opportunities through inorganic growth measures, such as acquiring smaller companies with valuable chip manufacturing technology.

The Semiconductor Market Is Recovering

The semiconductor industry is cyclical, which makes it important to understand the current stage of the cycle before investing in chip companies. These cycles, as empirical evidence suggests, may last a few years.

According to data from the Semiconductor Industry Association, global chip sales declined 8.2% year-over-year in 2023 to $526.8 billion after reaching a record high in 2022. However, in the second half of 2023, semiconductor sales gained momentum, which is evident from the 11.6% year-over-year growth in chip sales registered in the fourth quarter. Industry experts believe the semiconductor market will continue to recover in 2024, creating growth opportunities for leading chip manufacturers.

Deloitte projects global semiconductor sales to hit $588 billion this year, eclipsing the peak revenues reported in 2022. These expectations are grounded on a few favorable developments, including the easing supply chain disruptions, the continued demand for AI and other high-performance computing applications, and the expected comeback of the automotive sector.

Taiwan Semiconductor, as a leader in the global chip market, is well-positioned to benefit from these favorable developments in 2024.

TSM’s Competitive Strengths and Strategic Expansion

TSM’s earnings growth is propelled by its competitive advantages. The success of the company’s foundry business has been instrumental in building these advantages. Today, Intel Corporation (NASDAQ:INTC) is aggressively investing in its foundry business in a bid to change its fortunes, threatening Taiwan Semiconductor’s lead. However, these efforts are likely to take many years to meaningfully eat into TSM’s market share, if at all.

On another note, the company’s expansion into Japan should help it mitigate some of the negative impact resulting from the deteriorating relationship between the U.S. and China. TSM’s first fab plant in Japan began operations earlier this year, and a second fab is under construction in southwestern Japan, which is expected to be operational by 2027.

Is Taiwan Semiconductor a Buy, According to Analysts?

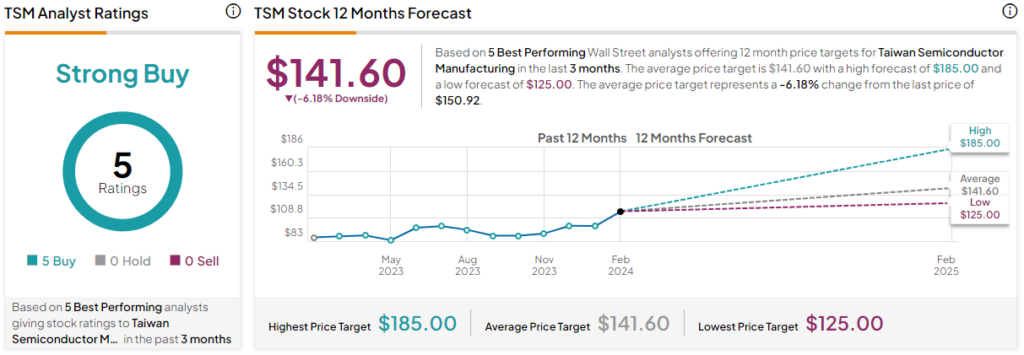

Recently, Bank of America (NYSE:BAC) analyst Brad Lin wrote that TSM is likely to stay ahead of Intel thanks to its technology leadership, attractive cost structure, and business model strengths. Overall, based on the ratings of five top-performing Wall Street analysts, the average Taiwan Semiconductor stock price target is $138.83, which implies downside potential of 6.2% from the current market price.

Based on Wall Street expectations, TSM seems slightly overvalued today, but not by much. That said, investing in a great business that isn’t very overvalued can still be a good bet, which is what Taiwan Semiconductor is today. The company is well-positioned to maintain its technological lead while expanding into new end markets.

The Takeaway: TSM Has More Room to Grow

Amid improving macroeconomic conditions, Taiwan Semiconductor is poised for strong revenue and earnings growth in 2024. Aided by several competitive advantages, the company is unlikely to be dethroned as the world’s largest contract chip manufacturer in the foreseeable future. TSM’s strong financial position, on the other hand, will help the company expand into new markets, reward shareholders handsomely through dividends, and look for potential acquisition candidates.