Tesla (TSLA) is losing ground to China’s BYD Co. (BYDDF) (HK:1211) in the electric vehicle (EV) space in a big way. According to preliminary data from research firm New AutoMotive, Tesla’s UK sales fell by 19% in November, while rival BYD’s surged 229% compared to the same period last year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Tesla faces renewed pressure to win back European customers as competition in the region intensifies. Also, CEO Elon Musk’s previous controversial remarks sparked consumer backlash in the region that continues to mount even this year. Local and Chinese rivals are gaining market share, while Tesla contends with an aging model lineup, production delays, and ongoing supply chain challenges that are stretching delivery times.

BYD gains, Tesla falters in Europe

Tesla sold 3,784 EVs in the UK last month, while BYD sold 3,217 autos, including hybrids. Although Tesla sold more cars in absolute terms, the American EV giant is steadily losing ground to BYD in key markets. Tesla had already reported a nearly 50% decline in UK sales in October.

Meanwhile, the overall car registrations in Britain declined 6.3% year-over-year, reaching 146,780 autos in November. Registrations of pure EVs fell by 1.1% to 38,742, while those of plug-in hybrids increased by 3.8% to 16,526 units.

Tesla’s sales in Europe also plunged over 50%. Registrations, a close proxy for sales, plummeted 58% in France to 1,593 units, 49% in Denmark to 534 units, and 59% in Sweden to 588 units. Norway, by contrast, reported a 34.6% year-over-year increase in Tesla’s EV sales.

Tesla Shows Resilience in China

In China, Tesla posted a 9.9% year-over-year jump in sales, while China’s own BYD saw a 5.3% decrease. Nonetheless, BYD remains on track to surpass Tesla as the world’s top seller of battery electric vehicles this year, despite domestic hurdles. The company is rapidly expanding and gaining market share outside China.

BYD is benefiting from Tesla’s struggles in Europe, where BYD outsold Tesla more than two to one in October, indicating the global race is still open.

TSLA or BYDDF: Which Is the Better EV Stock?

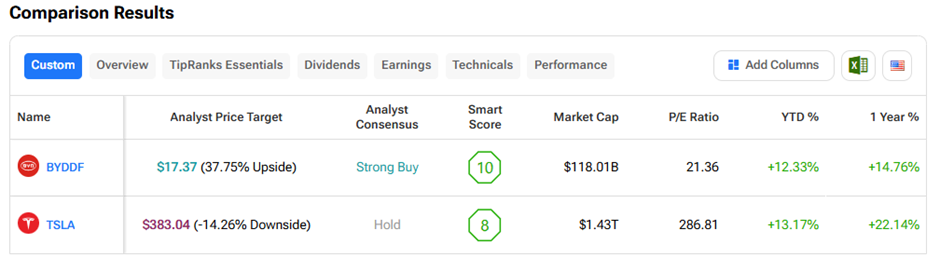

Based on TipRanks’ Stock Comparison Tool, analysts currently assign a Strong Buy consensus rating to BYDDF and a Hold rating to TSLA. BYD also boasts a 37% upside potential, but Tesla’s average price target suggests that shares may decline further over the next twelve months.