Tesla (TSLA) stock ticked higher in Thursday morning’s pre-market, but investors are already eyeing Washington — not earnings or Elon. A key Senate vote today could fire the next shot in a growing regulatory war over who gets to call the shots on air pollution standards. The outcome could ripple through Tesla’s credit business, and potentially, its clean-tech dominance.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

TSLA Faces Uncertainty as Senate Targets EPA’s California Waiver

At the heart of today’s drama is a Congressional Review Act (CRA) vote, aimed at stripping California of its special EPA waiver to regulate vehicle emissions more aggressively than federal standards. It’s not just procedural noise — this waiver underpins California’s Advanced Clean Cars II program, which mandates that roughly two-thirds of all new vehicle sales be zero-emission by 2030.

That’s a steep climb, considering EVs make up only about 20% of California’s car sales today, and a modest 7–8% nationwide. But for Tesla, California’s rules are more than just friendly policy — they’re profitable.

Tesla Could Take a Hit on ZEV Credit Revenue

Here’s where it gets material: Tesla has earned roughly $2.9 billion in the past year from selling Zero Emission Vehicle (ZEV) credits, many of which are fueled by California’s stricter standards. If Congress succeeds in gutting those rules, that cash pipeline could start drying up.

So far, the market isn’t panicking. Tesla stock has been surprisingly unfazed. TSLA shares are up nearly 19% in May, riding momentum that has little to do with regulatory headlines.

Part of the reason? Investors are laser-focused on what’s next — and that’s AI, autonomy, and robotaxis. Tesla is set to launch its much-hyped robotaxi service in Austin this June, and the bulls are betting hard on software, not smog credits.

This Senate vote is just one step in what’s likely to be a long and winding legal battle over emissions and federal preemption. That gives Tesla time.

Is Tesla a Buy, Sell, or Hold?

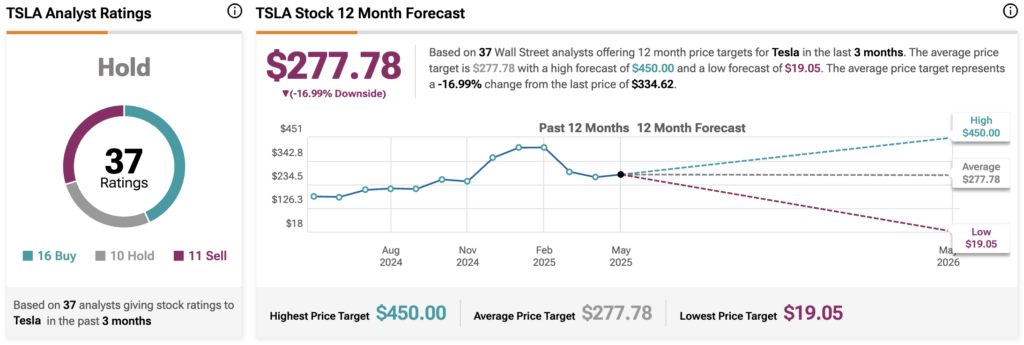

According to 37 Wall Street analysts tracked over the past three months, Tesla (TSLA) is currently rated a Hold. Out of the group, 16 recommend a Buy, 10 say Hold, and 11 are calling Sell — a rare split that signals real uncertainty over the company’s near-term direction.

The average 12-month TSLA price target sits at $277.78, which implies a 16.99% downside from the current price of $334.62.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue