Tesla (TSLA) stock has risen 18% year-to-date while Rivian (RIVN) shares have rallied 57% over the same period. Despite ongoing pressures in the electric vehicle (EV) market, including the end of the $7,500 tax credit and intense competition, Tesla stock has risen due to optimism about the company’s full self-driving (FSD) technology, robotaxis, and Optimus humanoid robots. Meanwhile, Rivian investors expect the company’s prospects to improve with the launch of its R2 SUV next year and are upbeat about its in-house artificial intelligence (AI) chip.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Heading into 2026, Wall Street is cautious on the stocks of these two American EV makers. In fact, the average price targets for Tesla and Rivian stocks indicate a downside risk from current levels.

Wall Street Weighs in on Tesla Stock

Recently, Canaccord Genuity analyst George Gianarikas increased the price target for Tesla stock to $551 from $482 and reaffirmed a Buy rating. Despite revising Q4 delivery expectations lower, the 4-star analyst remains bullish on Tesla, as he believes that “the reset in the U.S. EV market is laying the groundwork for a more durable and attractive long-term demand environment.” Gianarikas also noted rising EV adoption in emerging markets, supporting Tesla’s multi‑year growth opportunity beyond the U.S.

The analyst views the global progress in FSD and the expected expansion of the robotaxi fleet in 2026 as key aspects of Tesla’s growth story. He expects sentiment toward Tesla’s non-automotive businesses to improve in 2026, backed by any potential favorable updates on TSLA’s Optimus humanoid robot.

Meanwhile, Truist analyst William Stein raised his price target for Tesla stock to $444 from $406 and reaffirmed a Hold rating. The 5-star analyst continues to associate most of Tesla’s value with its success in launching its AI offerings. In this regard, Stein highlighted the robotaxi business, which is powered by TSLA’s FSD technology. He expects the EV giant to announce the rollout of the robotaxi service to new cities in 2026, though the timing of such announcements is expected to be unpredictable. Stein expects this unpredictability, along with any imperfections in FSD outcomes and rivals’ news flow, to keep TSLA stock volatile.

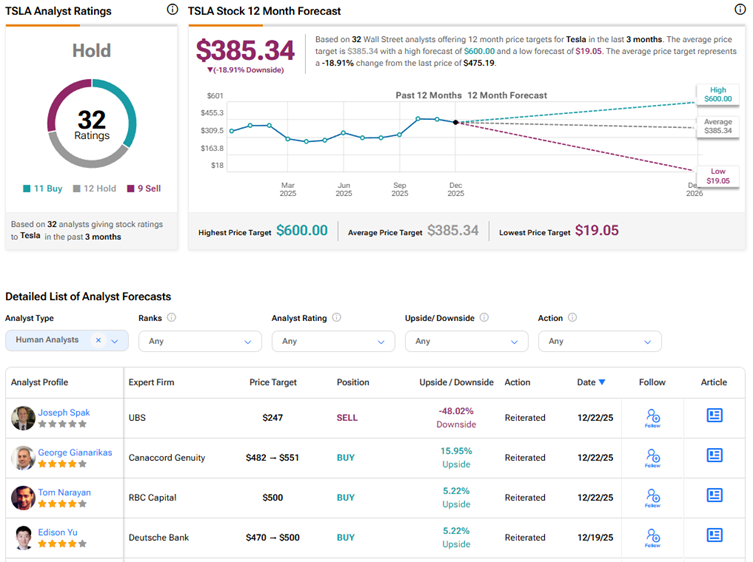

Is TSLA Stock a Buy, Sell, or Hold?

Overall, Wall Street has a Hold consensus rating on Tesla stock based on 11 Buys, 12 Holds, and nine Sell recommendations. The average TSLA stock price target of $385.34 indicates 19% downside risk from current levels.

Analysts Have Mixed Views on Rivian Stock

Recently, Baird analyst Ben Kallo upgraded Rivian Automotive stock to Buy from Hold and increased the price target to $25 from $14, calling 2026 “the year of the R2 launch.” Kallo expects R2 to boost the Rivian brand and product demand, and to drive the stock higher when deliveries begin near mid-2026. The 4-star analyst views the unveiling of RIVN’s custom chips and the in-depth overview of RIVN’s autonomous strategy at the Autonomy and AI day “positively for long-term competitiveness.”

Meanwhile, RBC Capital analyst Tom Narayan reiterated a Hold rating on Rivian stock with a price target of $14 following the company’s Autonomy and AI Day event. The analyst contends that while RIVN’s Autonomy+ feature could help enhance margins, low pricing for the service may continue unless the company offers an “eyes-off” driving option. The 4-star analyst added that while the technology upgrades revealed by Rivian make its vehicles more appealing, they do not address the ongoing concerns about the company’s liquidity and the profitability of the upcoming R2 and R3 models.

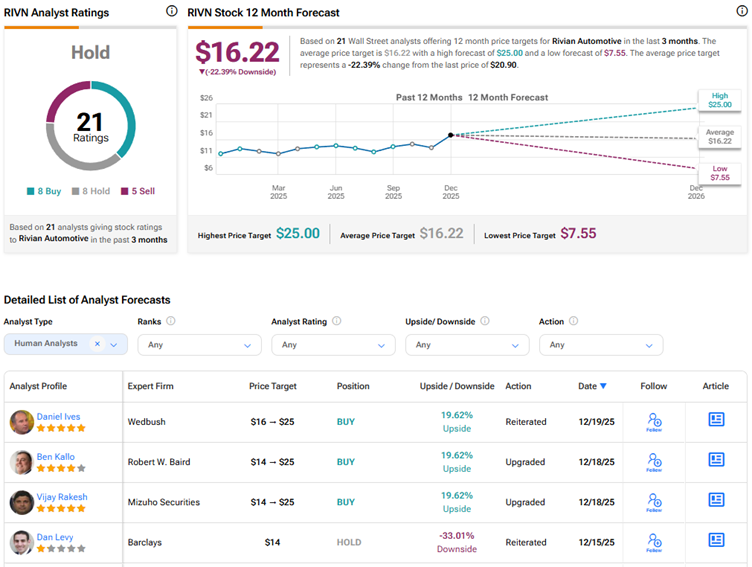

Is RIVN Stock a Good Buy?

Currently, Wall Street has a Hold consensus rating on Rivian Automotive stock based on eight Buys, eight Holds, and five Sell recommendations. The average RIVN stock price target of $16.22 indicates 22.4% downside risk.