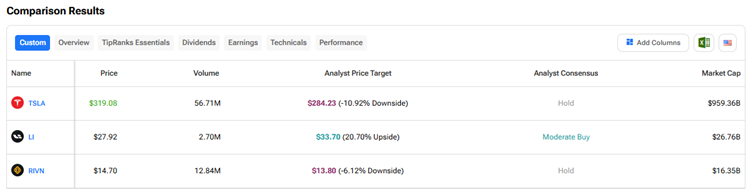

Electric vehicle (EV) makers have been under pressure due to concerns over a slowdown in demand amid macro uncertainties triggered by trade wars and intense competition. Nonetheless, the deal between the U.S. and China to temporarily slash tariffs eased trade tensions and triggered a rally in stocks on May 12. Despite the ongoing uncertainty, Wall Street remains bullish on some EV stocks. Using TipRanks’ Stock Comparison Tool, we placed Tesla (TSLA), Li Auto (LI), and Rivian Automotive (RIVN) against each other to find the EV stock that could offer the most attractive upside, according to Wall Street analysts.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Tesla (NASDAQ:TSLA)

TSLA stock has recovered 27% over the past month but is still down 21% year-to-date. Concerns about the company’s unimpressive deliveries due to intense competition and macro challenges, tariff woes, and the distraction caused by CEO Elon Musk’s political ambitions weighed on investor sentiment.

The stock gained over the past month as Musk said that he would spend less time at the Department of Government Efficiency (DOGE) and devote more time to his job at the EV maker. Easing of tariff wars with the U.K. and other countries also improved investor sentiment.

Nonetheless, weakness in Tesla’s deliveries in key markets like the U.S., Europe, and China continues to be a matter of concern. Last month, the company reported a decline in its revenue and earnings for Q1 2025. All eyes are now on the launch of Tesla’s affordable EVs and robotaxis.

Is TSLA a Buy, Sell, or Hold?

Recently, Piper Sandler analyst Alexander Potter reiterated a Buy rating on Tesla stock with a price target of $400. Following an investor call with Elias Martinez, creator of the FSD Community Tracker (https://teslafsdtracker.com/), Potter said that by a wide margin, Tesla’s full self-driving (FSD) software is the largest contributor to his price target.

Given the rapidly approaching launch date for robotaxis in Austin, the 5-star analyst thinks that investors are scrutinizing the FSD issue more closely than ever. After the investor call, Potter stated that it seems evident that the current version of FSD software (v13) cannot support truly autonomous vehicles. He added that it has been 4.5 months since Tesla unveiled v13, and during this period, the company has likely been focusing on ensuring a safe launch in Austin, and behind-the-scenes progress may not be evident in the FSD Community tracker.

Currently, Wall Street has a Hold consensus rating on Tesla stock based on 16 Buys, 10 Holds, and 11 Sells. The average TSLA stock price target of $284.23 implies about 11% upside potential.

Li Auto (NASDAQ:LI)

Li Auto is one of the prominent players in China’s new energy vehicle (NEV) market. Earlier this month, the company announced a 31.6% year-over-year growth in its April deliveries to 33,939 vehicles. However, April deliveries declined 7.5% on a sequential basis.

The company highlighted that it maintained the highest market share for SUVs priced above RMB 200,000 for three consecutive months. Li Auto attributed its dominance to its Li L series models.

Li Auto is upbeat about the demand for its innovative EV offerings. The company unveiled Li MEGA Home, Li MEGA Ultra, and the new Li L6 at Auto Shanghai 2025.

Is Li Auto a Buy, Sell, or Hold?

Jefferies analyst Xiaoyi Lei increased the price target for Li Auto stock to $37.20 from $31 and reiterated a Buy rating. The 4-star analyst believes that the company “has more cards to play” in the second half of 2025. Additionally, he contends that the market has yet to price in Li Auto’s AI (artificial intelligence) initiatives.

Lei believes that Li’s early mover strategy in the large-scale deployment of supercharging stations on highways has helped in driving the rebound in the Mega model’s sales.

With six Buys and four Holds, Wall Street has a Moderate Buy consensus rating on Li Auto stock. The average LI stock price target of $33.70 implies 20.5% upside potential. LI stock has advanced 18% year-to-date.

Rivian Automotive (NASDAQ:RIVN)

Rivian recently reported its first-quarter results, delivering a lower-than-anticipated loss and upbeat revenue. Moreover, Q1 2025 marked the second consecutive quarter of positive gross profit for the American EV maker. The company maintained its earnings guidance for the full year.

However, investors were disappointed as Rivian lowered its full-year deliveries target due to tariffs and trade wars. Rivian now expects deliveries in the range of 40,000 to 46,000 units, down from the previous outlook of 46,000 to 51,000 units. Further, it raised its full-year capital spending outlook.

Looking ahead, Rivian is gearing up for the launch of its R2 SUV next year. The company expects to revive demand through this less-expensive model.

Is RIVN Stock a Buy or Sell?

Following the results, UBS analyst Joseph Spak increased his price target for Rivian Automotive stock to $13 from $12, while retaining a Hold rating. The analyst noted some encouraging aspects related to Q1 results, including the fact that the quarter was gross profit positive for Rivian and that it achieved a milestone that secures a $1 billion equity investment from Volkswagen before June 2025, reducing capital concerns. He also highlighted that the cost of goods sold per unit reached the lowest level so far for the company.

That said, Spak pointed out some negatives, like the lowered delivery outlook and the incremental tariff cost (a few thousand/vehicle) in the second half of the year. The analyst contends that RIVN stock essentially depends on the launch of the R2 SUV, which remains on schedule, but “there is a bit of an air pocket for the stock until an AI day in the fall and getting closer to R2 launch in 1H26.”

Wall Street is sidelined on Rivian stock, with a Hold consensus rating based on seven Buys, 14 Holds, and four Sell recommendations. The average RIVN stock price target of $13.80 implies about 6% downside risk. RIVN stock has risen 12.3% so far in 2025.

Conclusion

Wall Street is sidelined on Tesla and Rivian stocks but cautiously optimistic on Li Auto stock. Analysts see continued upside in Li Auto stock while they see downside risk in the other two EV stocks. They are bullish on Li Auto’s long-term prospects due to its strong execution, solid financials, continued innovation, and strategic initiatives, including the expansion of its charging network.