The spotlight is back on U.S. automakers such as Tesla (TSLA), General Motors (GM), Rivian (RIVN), and Lucid (LCID), as President Donald Trump announced that he was rolling back his predecessor Joe Biden’s “burdensome” fuel efficiency standards.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s CAFE?

In 2022, the Biden administration, acting under the 1975 Corporate Average Fuel Economy (CAFE) law, introduced rules requiring U.S. automakers to lift the average fuel economy of passenger cars and light trucks for model year 2026 by nearly 10 miles per gallon versus model year 2021.

In 2024, the administration also adopted additional standards that mandate annual fuel-efficiency increases of 2% for passenger cars with model years 2027–2031 and 2% for light trucks with model years 2029–2031.

The move is targeted at ensuring that carmakers shift more significantly towards electric vehicles, which have better fuel economy and would make it easier to achieve the stated targets.

White House Calls Biden-Era Rules ‘Unrealistic’

However, in rolling back the rules, the White House, in a fact sheet, noted that “President Trump is returning CAFE standards to levels that can actually be met with conventional gasoline and diesel vehicles.”

It added that previous standards would have forced Americans to shift to EVs and increased the cost of living — something it said U.S. consumers did not ask for.

The White House further contended that the Biden-era rules — which it called “unrealistic” and “extraordinarily stringent” — would cost Americans an average of almost $1,000 to buy a new car compared to the cost under Trump’s newly relaxed rules. The White House expects the new rules to help Americans save about $109 billion over the next five years.

“Since EVs are so expensive to build, automakers must sell them at a loss and make up the difference by significantly raising the sticker price of gas cars,” the White House noted.

How Will Relaxed Rules Affect U.S. Automakers?

In addition to the companies mentioned above, Trump’s new rules will apply to several companies active in the U.S. automobile markets, including Toyota (TM), Honda (HMC), Stellantis (STLA), Mercedes-Benz (MBGYY), Nissan (NSANY), and Volkswagen (VWAGY).

One key impact on automakers could be in terms of sales and revenue. Trump recently signed legislation ending the current federal EV tax credits of up to $7,500 for new EVs and $4,000 for used EVs after September 30.

Anticipating the move, legacy automaker General Motors announced that it anticipated a $1.6 billion write-down on its account as part of the “strategic realignment” of its EV manufacturing capacity. EV maker Rivian warned that it could lose revenue of up to $100 million from selling regulatory credit.

However, automakers are expected to recalibrate their production strategies in line with the policy changes to reduce the impact on their business. In addition, top executives from some of these companies have noted that relaxed fuel economy rules would put less pressure on their business to meet carbon targets while giving more room to offer more affordable choices to buyers.

What are the Best EV Stocks to Buy?

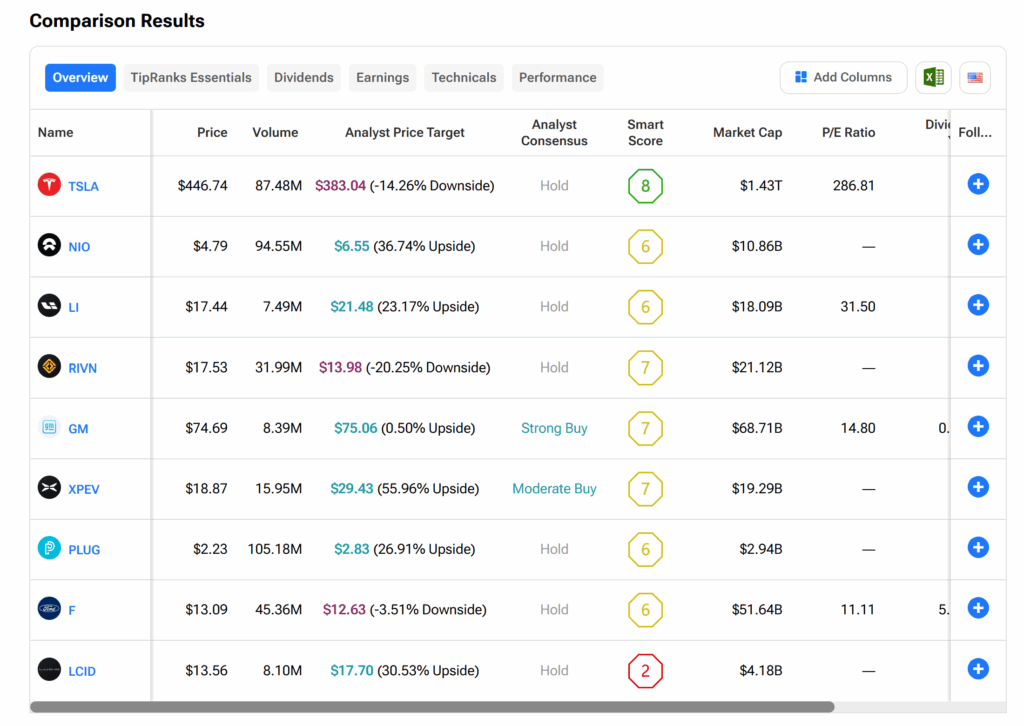

The TipRanks Stock Comparison tool offers insight into whether EV stocks, including those mentioned in this article, are worth buying based on Wall Street analysts’ most recent assessments. Kindly refer to the image below.