Shares of EV maker Tesla (TSLA) fell in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2024. Earnings per share came in at $0.52, which missed analysts’ consensus estimate of $0.61 per share.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

However, sales increased by 2.3% year-over-year, with revenue hitting $25.5 billion. This beat analysts’ expectations of $24.74 billion. The bump in sales can be attributed to an increase in Cybertruck deliveries, higher regulatory credits revenue, growth in the Energy/Storage business, and growth in Services. This was despite a reduction in the deliveries and average selling prices for its “S3XY” models.

Furthermore, free cash flow gained year-over-year, coming in at $1.3 billion compared to $1 billion in Q2 2023.

Investor Sentiment for TSLA Stock Is Currently Negative

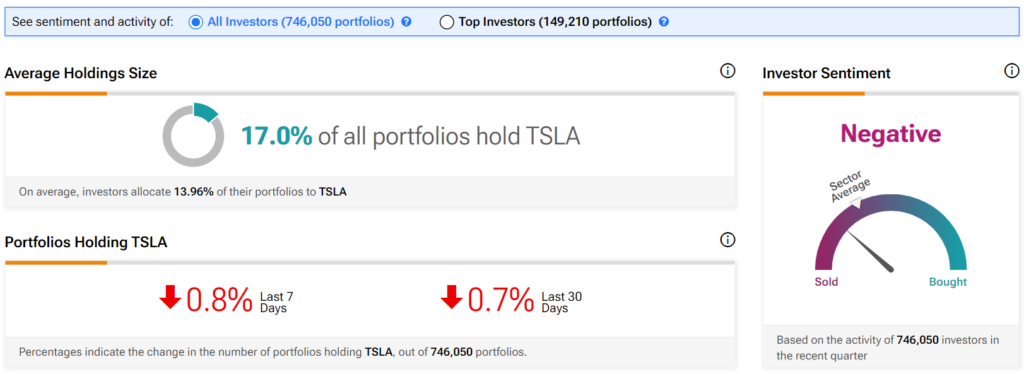

The sentiment among TipRanks investors is currently negative. Out of the 746,050 portfolios tracked by TipRanks, 17% hold TSLA stock. In addition, the average portfolio weighting allocated towards TSLA among those who do have a position is 13.96%. This suggests that investors of the company are very confident about its future.

However, in the last 30 days, 0.7% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

Is Tesla a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 13 Buys, 13 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. After an 8% decline in its share price over the past 12 months, the average TSLA price target of $193.18 per share implies 21.72% downside risk. However, it’s worth noting that estimates will likely change following today’s earnings report.