One day he’s a “loser,” the next day he’s keeping him in the job. President Donald Trump’s latest U-turn on Fed Chair Jerome Powell has grabbed attention and lifted markets.

On Monday, Trump criticized Powell during an interview, reviving his long-standing concerns over the Fed’s handling of interest rates. But by Tuesday, the tone shifted. He clarified that he has “no intention” of firing Powell, but only would prefer that he move faster on cutting rates.

That quick turnaround eased market concerns and triggered a rally, driving the Dow Jones Industrial Average (DJIA) up by over 1,000 points in yesterday’s session.

Trade Talk Adds More Fuel

Trump also hinted at potential tariff relief on Chinese imports, another comment that added to investor optimism. He expressed hope for a trade deal that could “substantially” lower tariffs, calling the current 145% rate “very high” and suggesting it would come down substantially.

Though he made clear the rate wouldn’t go back to zero, the shift toward negotiation was enough to boost market confidence.

Markets React to the U-Turn

On Wall Street, all three major indexes closed higher. The Dow Jones, the S&P 500 (SPX) and the Nasdaq (NDAQ) each gained over 2.5%, bouncing back from Monday’s dip.

Also, the U.S. dollar index, which measures the performance of the dollar against a basket of foreign currencies, rose to 99.64 on Tuesday after dipping to $97.923 on Monday, a level not seen since March 2022.

Investors usually worry about changes at the Fed, so Trump’s new comments reassured them, giving the stock market a boost. With indexes like the S&P 500 climbing, many are now looking for ways to ride the rally.

How to Invest in the S&P 500 Index

Investing in the S&P 500 Index (SPX) can be a good choice, especially during uncertain times. The index includes large-cap U.S. companies across various sectors, giving investors a balanced mix to reduce risk.

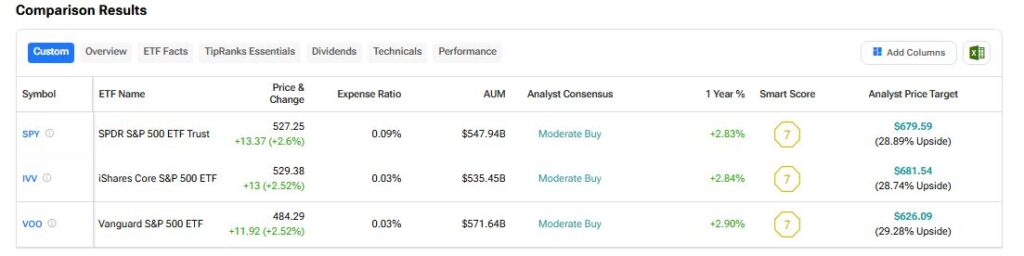

One of the easiest ways to invest in the S&P 500 index is through ETFs (exchange-traded funds). These funds track the index’s performance at a low cost. Some popular options are the SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 ETF (IVV), and Vanguard S&P 500 ETF (VOO).

According to the TipRanks ETF Comparison tool, all three ETFs have a Moderate Buy consensus rating and have an upside potential of over 25%.