Shares in Swiss engineering group ABB (ABBNY) were stronger today after it said that it was expanding its production capacity in the U.S. as a result of President Trump’s tariffs strategy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ABB Will Invest

Chief executive Morten Wierod said the company had already vowed to spend $120 million to beef up its production of low voltage electrical equipment in the U.S. at its sites in Tennessee and Mississippi but it will continue to invest.

“In India we have a target to get to above 90% local production. We have the same target in China, Europe and also the U.S.,” he said. “We will do this mainly through organic investments, but inorganic moves can also be a part of that.”

According to Reuters, currently 75-80% of ABB’s sales for the United States are produced domestically, while 85% of its sales in India and China are produced locally. In Europe the figure is around 95%.”We have spent about $500 million over the last three years in the U.S. The overall spending will go up rather than down. We will see more of that to become less dependent on imports from outside the U.S.” he said.

His inorganic comment is business speak for acquisitions which would be an interesting addition to what is slowly becoming a trend of global companies upping U.S. capacity to mitigate the impact of Trump’s Tariffs strategy.

A Growing Trend?

Japanese car firm Honda (HMC) has plans to increase U.S. vehicle production by as much as 30% over an extended multi-year period. Swiss drugmaker Novartis (NVS) has also set out plans to invest $23 billion in U.S. manufacturing to beat the tariffs threat against the industry.

ABB’s move to potentially consider acquisitions of U.S. firms is a new twist and will bring even more color to the cheeks of President Trump.

One of the reasons behind his tariffs crusade has been to ramp up U.S. manufacturing and production and boost domestic jobs. The signs, so far, are encouraging.

Is ABBNY a Good Stock to Buy?

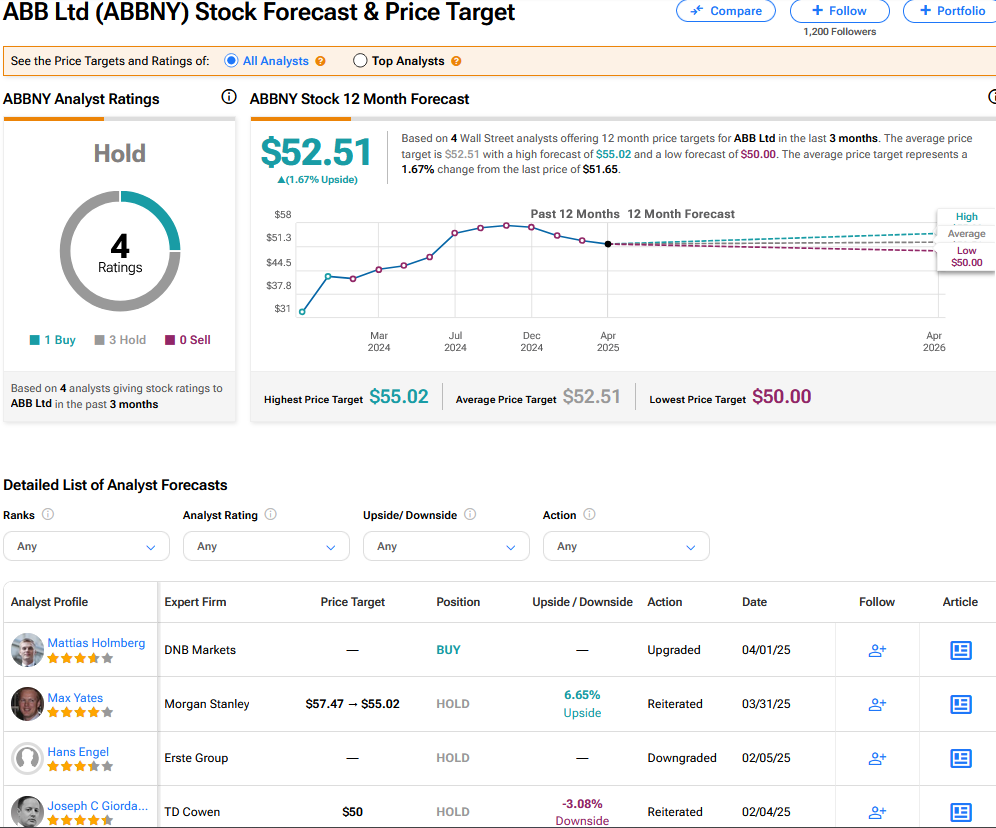

On TipRanks, ABBNY has a Hold consensus based on 1 Buy and 3 Hold ratings. Its highest price target is $55.02. ABBNY stock’s consensus price target is $52.51 implying an 1.67% upside.