President-elect Donald Trump could float the idea of a tariff on chips imported from Taiwan. Such a move could have a widespread impact on the chip industry. In fact, Trump first suggested the idea of tariffs on chips during an appearance on Joe Rogan’s podcast ahead of the election. He strongly criticized the CHIPS Act, a bipartisan law signed by Biden in 2022 to bring semiconductor manufacturing back to the U.S.

Trump called it “so bad” and dismissed the idea of using subsidies to attract chip-making facilities, arguing that tariffs could achieve the same result more effectively. During the podcast, Trump stated that he would impose tariffs on chips imported from Taiwan, though he didn’t specify how much.

Trump’s Proposed Tariffs Could Badly Hit the Chip Industry

According to Trump’s estimates, imposing tariffs on chipmakers like TSMC (TSM) from Taiwan could incentivize them to establish manufacturing plants in the U.S. to avoid paying taxes. However, such a move would not guarantee that chipmakers would absorb the added costs rather than passing them on to customers or setting up expensive U.S. facilities.

Furthermore, companies like Nvidia (NVDA) and AMD (AMD), which rely heavily on Taiwan-built chips, could see their profit margins squeezed unless they too pass costs down the line. Such ripple effects could disrupt pricing and innovation across the tech industry.

On the other hand, according to a Yahoo Finance report citing Futurum Group CEO Dan Newman, if such tariffs are imposed on chips coming out of Taiwan, they could push chip designers to rely on domestic fabs, such as Intel’s (INTC) facilities.

Reshoring Chips Strengthens National Security

Trump’s remarks come at a time when reshoring chip manufacturing has become a key national security goal. This is due to the COVID-19 pandemic exposing vulnerabilities in the global chip supply chain, particularly America’s dependence on Taiwan. In fact, according to a Yahoo Finance report citing the U.S. International Trade Commission report from last year, Taiwan accounted for 44% of U.S. logic chip imports in 2021. Furthermore, the report warned that a major disruption in Taiwanese manufacturing could cause the price of U.S. chips to spike by as much as 59%, leaving U.S. capacity unable to fully bridge the gap.

What Are the Best Chip Stocks to Buy?

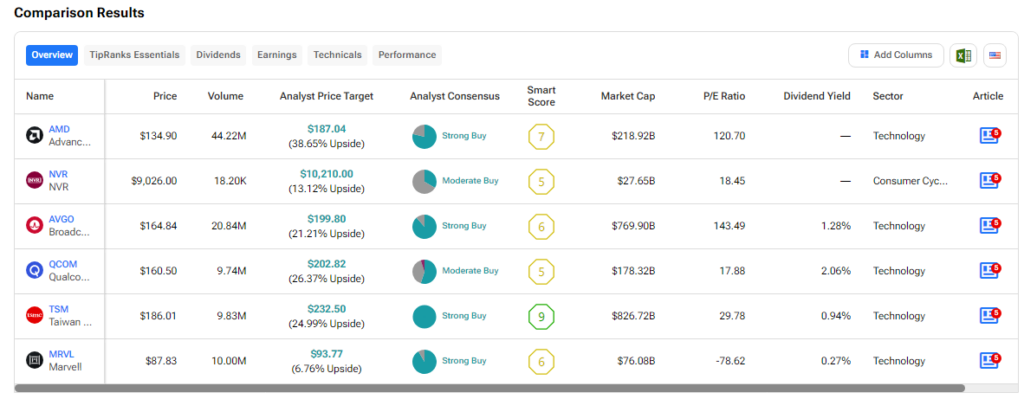

For investors interested in chip stocks, we used the TipRanks Stock Comparison tool to compile a list of the best chip stocks to buy, each of which has been rated as either bullish or cautiously optimistic by Wall Street analysts.

Questions or Comments about the article? Write to editor@tipranks.com