Donald Trump is preparing to return to the White House, and his planned environmental policies could threaten the recent progress of blue economy exchange-traded funds (ETFs). ‘Blue economy’ refers to funds that track the progress of companies whose work actively benefits the world’s oceans. So far this year, the KraneShares Rockefeller Ocean Engagement ETF (KSEA) has outperformed many of its peers. However, if Trump’s plans to roll back pro-climate regulations proceed, ETFs like KSEA are likely to struggle.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Which Blue Economy ETF Is the Best Buy?

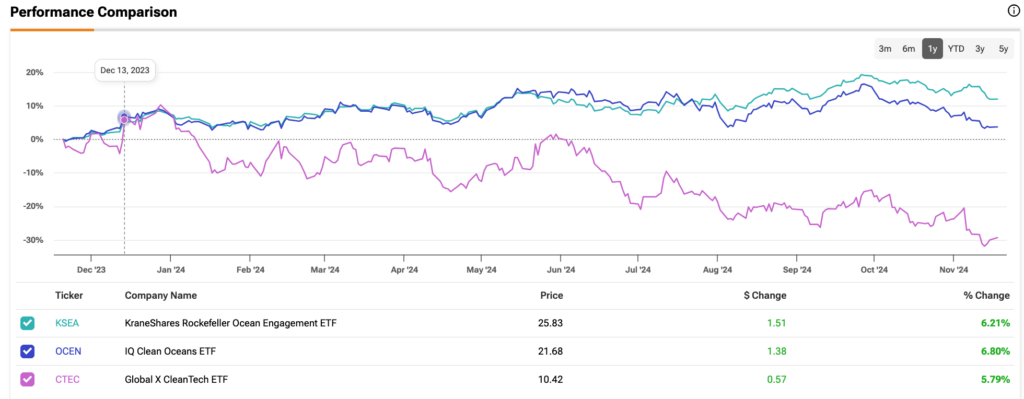

While all three Blue Economy ETFs are likely to be impacted by Trump’s policies, KSEA is most likely to withstand the negative effects, making it the best buy among its peers. The TipRanks ETF Comparison tool highlights the fund’s performance over the past year, demonstrating its ability to shake off unfavorable market conditions.

It’s true that KSEA isn’t solely focused on companies in the clean energy space. Its top holding is Waste Management (WM), a company that has enjoyed a year of slow but steady growth. Behind that is Trimble (TRMB), a software producer that also manufactures global navigation satellite system receiver hardware. Both of these companies could likely withstand Trump’s anti-climate policies, even if demand declines.

The IQ Clean Oceans ETF (OCEN) may be in trouble, though. It boasts high exposure to companies like First Solar (FSLR) and American Water Works Company (AWK). Additionally, the Global X CleanTech ETF (CTEC) could be compromised. Its top holdings include fuel cell energy producer Bloom Energy (BE) and solar tracking company Nextracker (NXT). All four are likely to struggle under Trump, as his administration prioritizes oil drilling over clean energy.

Wall Street Is Bullish on the KSEA ETF

Turning to Wall Street, analysts have a Moderate Buy consensus rating on KSEA ETF based on 32 Buys and 12 Holds assigned in the past three months, as indicated by the graphic below. After a 12% rally in its share price over the past year, the average KSEA price target of $31.10 per share implies 14% upside potential.