Global IT leader Accenture (ACN) has long been at the forefront of large-scale government and private sector projects. However, with the incoming administration creating the so-called Department of Government Efficiency (DOGE), the landscape could shift dramatically for providers working closely with federal partners. With Elon Musk and Vivek Ramaswamy at the helm, DOGE has a particularly aggressive mandate: cutting approximately $2 trillion from government spending, eliminating regulatory burdens where possible, and performing widespread audits of federal contracts. From my perspective, this could pose an enormous risk to Accenture, with public service contracts representing a large part of the company’s revenue. So, while the company clearly has a diverse and innovative range of capabilities, I think DOGE could make me fairly bearish for the coming years.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Accenture’s Business Overview

I’ve been a huge fan of what Accenture does for some time now, but I’ve got concerns that it might have a challenging few years ahead. Few would disagree that the company is a giant of the global consulting world, with a robust portfolio across five key areas:

- Strategy and Consulting

- Technology

- Operations

- Interactive

- Industry X.0

Leadership across some of the most lucrative and dynamic sectors in recent years, including digital transformation, cloud services, AI, and more has move the share price higher over the last year, albeit much more modestly than many of the companies partnered with.

Growth across emerging areas in cybersecurity at 23% also helped the business in the latest quarter, with an impressive $64.9 billion in revenue and margins of 11%, beating industry peers.

As I noted, public service contracts make up a fairly hefty portion of revenues, at 21% in the latest report. This has been a key driver of profitability, with stable income and high margins from activities such as modernizing IT systems across government departments and implementing AI solutions at scale. Although this was seen to grow over recent years, I have genuine concerns about how a heavy reliance on public sector spending could change over the next administration’s period, particularly amid a culture of cost-cutting and reduced reliance on consultants.

Accenture Faces New Risks with DOGE

With so much exposure to government contracts, I’m deeply concerned that the company sits right in the crosshairs of DOGE’s mandate. The team in charge has encouraged a culture of cutting and then reintroducing, so I see some major disruption to the sector over the coming years. As much as this may be largely beneficial for taxpayers, it could be seriously damaging to Accenture’s Federal Services team.

By auditing and challenging the need for each of the company’s contracts, both new and old, DOGE will scrutinize deals made, potentially leading to renegotiations with partners, delays in payments, or even termination of some. There’s also the potential that, with AI systems in place, a streamlined federal agency will have little need for consultants, other than occasional check-ins or ideations.

Then there’s the likelihood that DOGE will be looking to consolidate or eliminate entire government agencies. With no department in place, the deals made will either be suddenly open to termination or lengthy renegotiation, which could seriously concern investors thinking about future revenue opportunities. Management may be forced to rethink its strategy, either lowering prices to compete with smaller contractors offering cheaper rates or accepting tighter margins on future contracts.

Accenture’s Valuation Seems Concerning

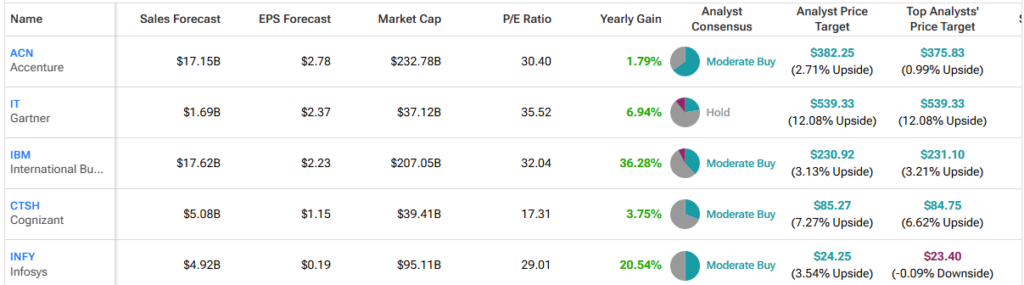

As much as the business has performed fairly well over recent years, a sudden change in investor sentiment could be damaging to the share price. At a price-to-earnings ratio (P/E) of 30.4 and a PEG ratio of 3.3, I’d be concerned that the company is slightly detached from the rest of the industry. Fairly sluggish revenue growth of 1-2% in the last year indicates to me that management may struggle to maintain this premium valuation if public sector contracts begin to dry up.

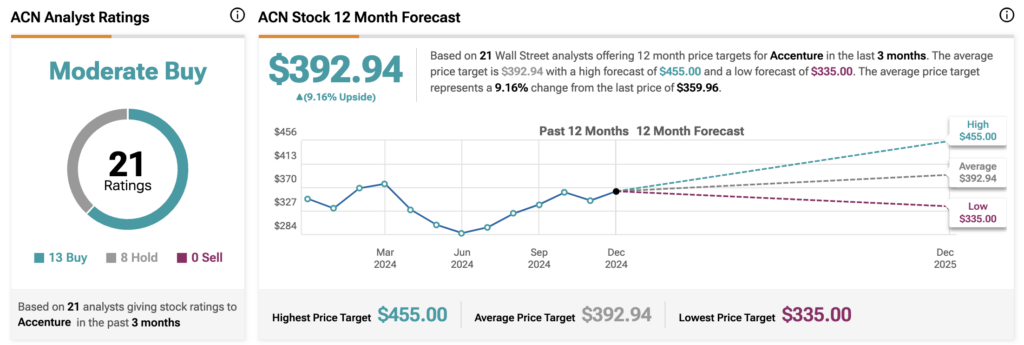

Wall Street seems to generally agree with the uncertainty I’ve noted, giving ACN stock a Moderate Buy rating. The average ACN price target of $392.94 implies an upside potential of 9.2% from current levels.

While the sector digests the potential changes for the next few years, I suspect Accenture will have to be much more agile than its competitors. Smaller companies, such as Infosys (INFY), are also likely to be impacted by consolidated agencies, a reduction in the federal workforce, and general cost-cutting, but their lower-cost structures may be more appealing to the new administration as smaller-scale contracts are awarded. Accenture may be limited in how such contracts are negotiated due to its history of enterprise-level, holistic consulting and delivery.

Of course, the business is more than just one department, and with the emergence of Generative AI and other services, there is plenty of opportunity for the company to pick up slack even if government services decline in the near term. Longer-term contracts also mean that revenues will not exactly dry up overnight, even if investors enter a period of uncertainty and analysts begin a downgrade cycle, as this potentially slows.

Not All Is Lost for Accenture

Despite my generally bearish sentiment here, there are plenty of reasons to like what the company is doing too. Other sectors such as healthcare, banking, and telecoms are seeing encouraging growth, and areas I’ve noted, such as cybersecurity and cloud services, show no sign of slowing any time soon. If the company can maintain a strong relationship with key government and private partners, encourage and drive efficiency, and innovate over the long term, I don’t see why the premium valuation cannot be justified and improved upon for investors.

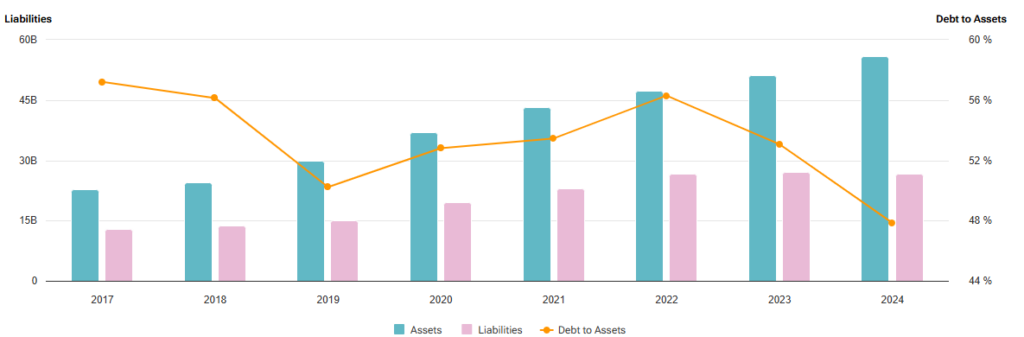

A strong balance sheet, with a stable cash reserve of $5 billion comfortably outweighing the $4.1 billion debt held, and an encouraging debt-to-equity downward trend, sets the company up well for investments in future initiatives and, of course, for managing the coming uncertainty.

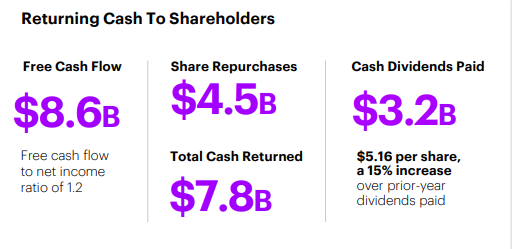

Management has also been working hard to reward shareholders, with a series of buybacks and dividend raises in the last year. Although a 1.5% dividend is unlikely to move the needle for many investors, it shows that cash is being steadily returned to shareholders, even as the sector goes through a fairly volatile period.

Key Takeaway

Generally speaking, I think the company is performing well in a difficult and uncertain landscape. As much as business fundamentals are solid and management is doing all the right things, I’d suggest that the next few years won’t be particularly lucrative for the consulting space. With such a focus on efficiency, the high margins being earned by consultants are hard to justify for government contracts, so they will likely be heavily scrutinized and scaled down over time. I would imagine other areas of Accenture’s business model will help to pick up the slack to some extent, but I’d be inclined to say there will be better opportunities elsewhere in the coming years.