President Donald Trump has threatened to introduce trade tariffs on semiconductors from foreign countries, potentially affecting Taiwan Semiconductor Manufacturing Company (TSM). Details of the tariffs weren’t revealed, but investors will note that Trump’s other threats include 25% tariffs on Canada and Mexico.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Semiconductors aren’t the only products President Trump intends to target with his latest tariff threats with plans to hit steel and pharmaceuticals from Asia. This is part of his plan to encourage manufacturing in the U.S. to avoid the hefty tariffs.

President Trump’s push to bring manufacturing back to the U.S. has already seen some success from his first term in office. TSMC is already developing a manufacturing facility in Arizona, but most of its production will remain in Taiwan. That could negatively affect tech companies such as Nvidia (NVDA) and Apple (AAPL), which are among its biggest customers.

What This Means for TSMC

TSMC is the world’s largest manufacturer of semiconductors and North America is its biggest customer. That means Trump’s tariffs could impact the business and the lives of residents in the U.S., increasing product prices as TSMC takes time to expand its operations outside of Taiwan.

However, Taiwan’s leaders aren’t expecting much trouble from President Trump. Taiwan’s Ministry of Economic Affairs responded to Trump’s threats saying it will “pay attention to U.S. policy going forward, and there will be close contact and cooperation between the two sides to ensure that Taiwan’s and U.S.’ industries and national interests can develop in a mutually beneficial way in the face of global challenges.”

Is TSM Stock a Buy, Sell, or Hold?

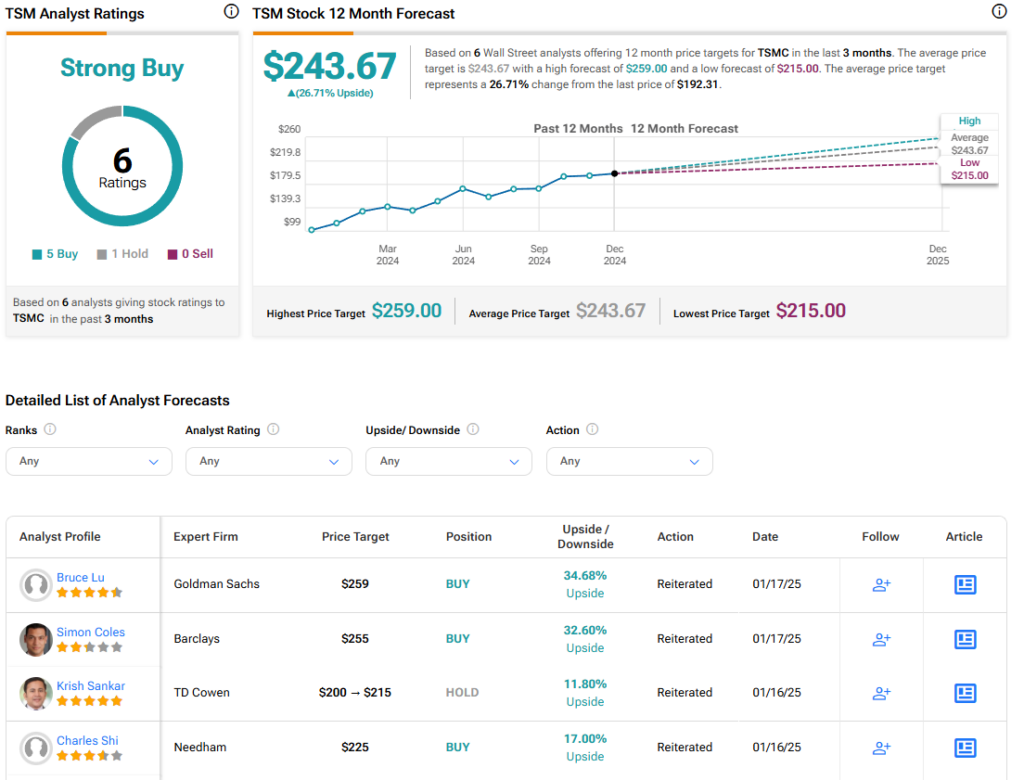

Turning to Wall Street, the analysts’ consensus rating for Taiwan Semiconductor Manufacturing Company is Strong Buy based on five Buy and one Hold ratings over the last three months. With that comes an average price target of $243.67, a high of $259, and a low of $215. This represents a potential 26.71% upside for TSM shares.