President Donald Trump tried to calm investors on Friday by assuring them that the U.S. is still a strong place to put their money. In a social media post, he told investors that his economic policies will “never change” and that now is “a great time to get rich, richer than ever before.” He also pointed to strong March jobs data as a sign that his policies are working, adding, “HANG TOUGH, WE CAN’T LOSE!!!”

Despite his optimism, the major indices — S&P 500 (SPY), Nasdaq 100 (QQQ), and Dow Jones (DIA) — are sharply down in early Friday trading. In addition, the 10-year Treasury yield dipped below 4% to 3.94%, while the Dollar Index inched up by 0.1%. This points to growing fear among investors, especially since China responded with its own 34% retaliatory tariffs on all U.S. goods, which many believe has now triggered an international trade war.

Unsurprisingly, though, the president responded to China’s decision in typical Trump fashion. On Truth Social (DJT), he claimed that China had “panicked” and made a mistake by going down that path. “CHINA PLAYED IT WRONG, THEY PANICKED – THE ONE THING THEY CANNOT AFFORD TO DO!” he wrote. This adds to Trump’s long-running trade tensions with Beijing, which began during his first term and are now heating up again with his new wave of sweeping tariffs.

Is QQQ a Buy or Sell?

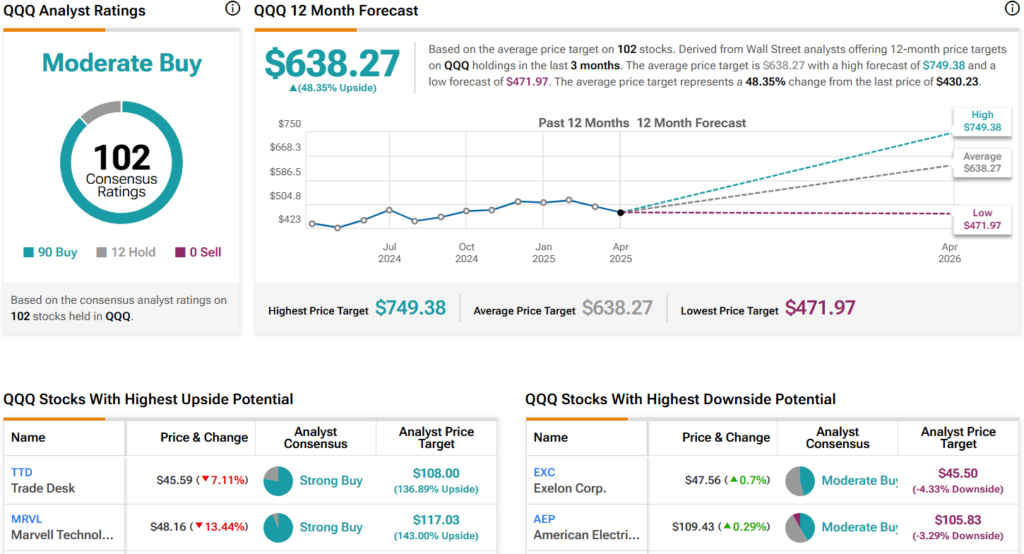

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QQQ based on 90 Buys, 12 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average QQQ price target of $638.27 per share implies 48.4% upside potential.