President-elect Donald Trump announced in a post on his social media platform, Truth Social, on Monday that he planned to impose an additional 10% tariff on all Chinese goods entering the United States. This statement came shortly after another post in which he vowed that his first executive order on January 20 would be to enforce a 25% tariff on all imports from Mexico and Canada, effectively ending the existing regional free trade agreement.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news of the tariffs, the U.S. dollar gained 0.1% against the Canadian dollar (USD-CAD), while it edged slightly lower against the Mexican peso at the time of writing.

Why Is Trump Imposing Tariffs on China?

As the countdown to his inauguration on January 20 continues, Trump has linked these tariffs to domestic concerns such as illegal immigration and the illicit drug trade, specifically pointing to the influx of fentanyl from China.

Trump commented, “I have had many talks with China about the massive amounts of drugs, in particular fentanyl, being sent into the United States – but to no avail.” Additionally, he has claimed that China failed to uphold its promise to impose severe penalties, such as the death penalty, on those involved in drug trafficking.

China Responds to the Tariffs News

In response, Liu Pengyu, spokesperson for China’s embassy in the U.S., stated on X that no party wins in a trade or tariff war. He described the economic and trade cooperation between the U.S. and China as historically “mutually beneficial.”

The U.S. Is China’s Largest Trading Partner

It is important to note that the U.S. is China’s largest trading partner. Meanwhile, according to a CNBC report citing U.S. data, Mexico is the largest trading partner of the U.S., followed by Canada and China. As a result, if these tariffs are imposed, they could substantially impact U.S. trade with these countries.

AAPL CEO Arrives in China

Meanwhile, Apple’s (AAPL) CEO Tim Cook and other U.S. business leaders are in China this week for the second annual “China International Supply Chain Expo,” which kicked off on Tuesday. Cook commented, “We’re very committed to China, that’s the reason I have been here three times.” He added that he expects the relationship to “only get better.”

Is FXI a Good Buy?

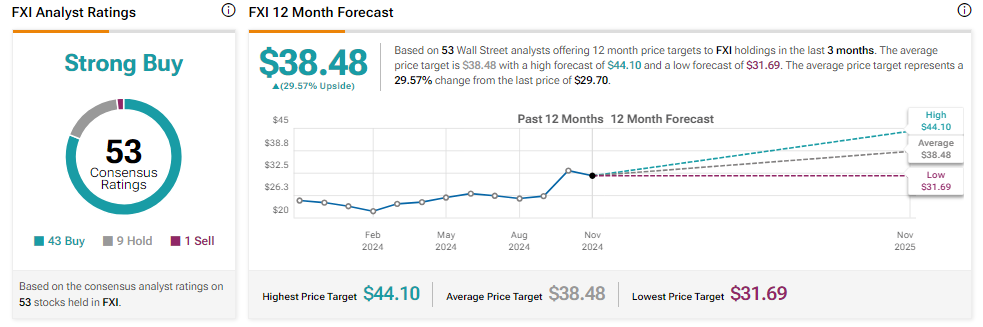

The China-focused iShares China Large-Cap ETF (FXI) has declined by more than 6% over the past month as the threat of tariffs looms. However, year-to-date, FXI has surged by more than 20%. Overall, analysts remain bullish about FXI, with a Strong Buy consensus rating based on 43 Buys, nine Holds, and one Sell. The average FXI price target of $38.48 implies an upside potential of 29.6% from current levels.