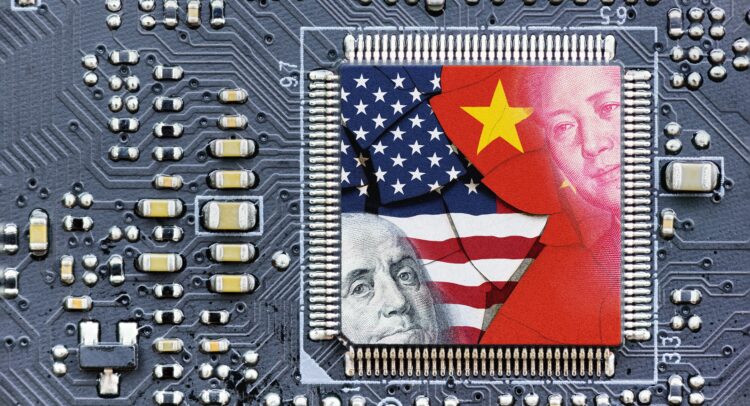

Trump administration officials are considering new restrictions on Nvidia (NVDA) chip sales to China. Indeed, they are focusing on the company’s H20 chips, which are used for artificial intelligence software and services. These chips are a scaled-down version that have been designed to meet existing U.S. curbs on shipments to China. The new potential restrictions are still in the early stages, with Commerce Secretary nominee Howard Lutnick pledging to be “very strong” on semiconductor controls.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

A decision to tighten restrictions would undoubtedly increase the tensions between the U.S. and China, particularly as the U.S. government and tech industry respond to China’s rapid advancements in AI. Interestingly, Nvidia has been under restrictions since 2022 and argues that these restrictions will reinforce China’s determination to become independent of U.S. technology, which could ultimately weaken U.S. companies.

This new scrutiny on Nvidia chips comes after Chinese startup DeepSeek released a new AI model that rivaled those from Microsoft-backed OpenAI (MSFT), Google (GOOGL), and Meta Platforms (META), which led to a significant decline in tech stocks on Monday. In addition, it is worth noting that Microsoft and OpenAI are investigating the potential for unauthorized data access related to DeepSeek’s AI model.

Which AI Stock Is the Better Buy?

Turning to Wall Street, out of the four stocks mentioned above, analysts think that NVDA stock has the most room to run. In fact, NVDA’s average price target of $178.32 per share implies more than 47% upside potential. On the other hand, analysts expect the least from META stock, as its average price target of $693.51 equates to a gain of just 2.9%.