According to a Reuters report, U.S. President Donald Trump is considering a plan that could lower the cost of making cars in America. The plan would give major automakers tariff relief if they build or assemble most of their vehicles in the U.S. Senator Bernie Moreno said the idea is to reward companies that hire U.S. workers and keep production local.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

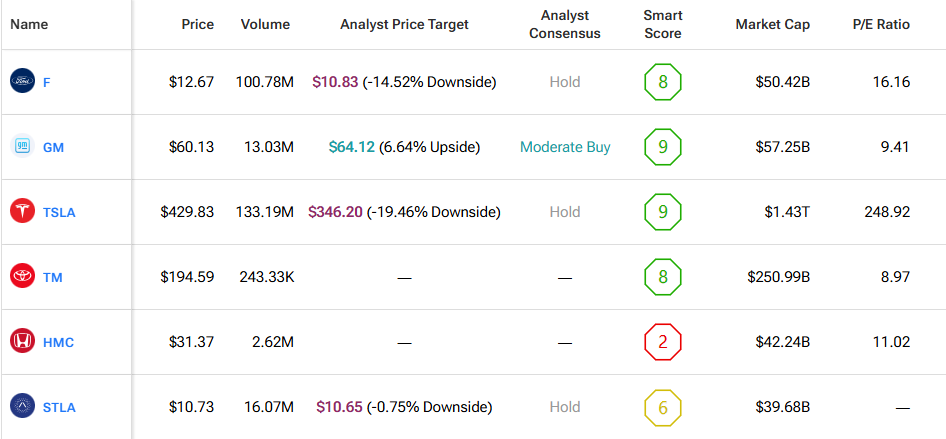

So far, companies that stand to gain the most include Ford (F), General Motors (GM), Tesla (TSLA), Toyota Motor (TM), and Honda Motor (HMC). These firms already have large assembly operations in the country. Moreno said the signal is clear: if a car company finishes production in the U.S., it could be free from new import tariffs.

Stock Gains Amid Reports

Investors welcomed the news. Ford closed up 3.7%, Stellantis (STLA) rose 3.2%, and General Motors gained 1.3% after the report. The move reflects market hopes that U.S. carmakers will see lower costs and better profit margins if the plan goes through.

Currently, the Commerce Department offers an import offset worth 3.75% of a car’s retail price for models assembled in the U.S. The credit is set to drop to 2.5% after April 2026. However, Trump is considering keeping the higher 3.75% rate for five years. He may also expand it to cover engines made in the U.S., giving companies more reason to move production home.

Moreno said the proposal would separate automakers that import cars from those that produce them locally. “They are doing what we want them to do,” he said, referring to companies that employ Americans and assemble cars in the U.S.

Industry Impact and Open Questions

If finalized, the plan would help companies offset part of the 25% tariffs Trump placed in May on imported vehicles and parts worth about $460 billion each year. Since then, the administration has reached partial trade deals with Japan, the UK, and the European Union to reduce those tariffs.

Still, some issues remain. The White House has not confirmed whether the new relief will cover steel and aluminum, which make up about $240 billion in annual imports and include many car parts. Automakers such as General Motors have warned that tariffs could cost the company up to $5 billion this year, while Ford expects a $3 billion hit.

Trump’s team also delayed a decision on heavy-duty truck tariffs while reviewing the economic effects. A White House official said the administration remains focused on policies that secure domestic auto and parts production but added that nothing is final until the president signs it.

Outlook for Automakers

For now, the idea of tariff relief is giving U.S. carmakers a lift in the market. The plan could improve profit margins for companies that already have strong American assembly lines. If the policy becomes official, it may further encourage global automakers to expand their production in the U.S.

In short, the proposal would favor firms that make cars where they sell them, a long-term goal of Trump’s trade strategy. Until an official decision is made, investors and automakers alike are waiting to see how far the relief will go.

By using TipRanks’ Comparison Tool, we’ve compared all the tickers appearing in the piece. This is a great way for investors to gain a comprehensive look at each stock and the vehicle industry as a whole.