U.S. President Donald Trump said he did not discuss approving sales of Nvidia (NVDA) Blackwell chips to China during his meeting with Chinese President Xi Jinping. His comment cooled earlier speculation that Washington might soon allow the company to export its newest AI chips to the world’s largest chip market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Trump explained that he and Xi did speak about Nvidia’s access to China in general. He added that the company would continue to talk with Beijing on its own. When asked about possible exports of downgraded Blackwell chips, Trump replied that the U.S. was “not talking about the Blackwell.” The statement followed an earlier remark suggesting he might review the matter, which briefly fueled a rally in Nvidia’s stock.

Investor Reaction and Market Outlook

The clarification came after Nvidia became the first company to reach a $5 trillion market value. That surge was driven in part by investor hopes that a policy shift could open China to new chip sales. Now, those hopes are fading, and the market is adjusting its view of Nvidia’s near-term growth.

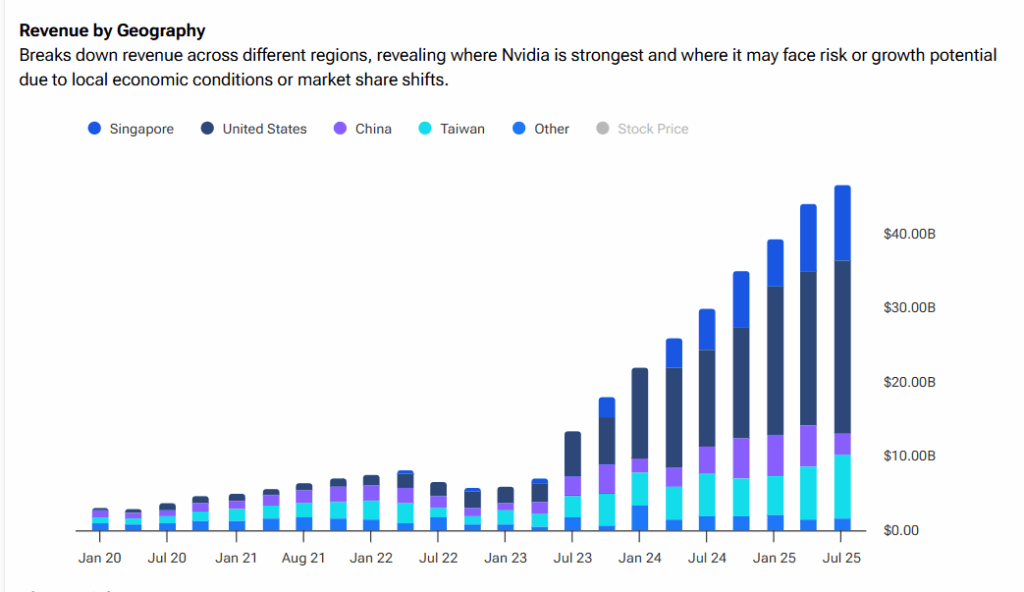

China remains the largest buyer of semiconductors, and Nvidia’s chips are key to training and running large-language models used in AI. However, U.S. limits introduced in recent years restrict sales of advanced processors to China. Those limits have already pushed some Chinese firms to turn to local suppliers such as Huawei Technologies.

Nvidia Chief Executive Officer Jensen Huang has warned that tighter restrictions could help China’s chipmakers grow faster. Even so, the company continues to lead the global market for AI chips and remains focused on data centers in the U.S. and other key regions.

For now, the chance of Nvidia shipping its top Blackwell chips to China seems remote. Investors will watch how trade talks between Washington and Beijing evolve, but the company’s growth story continues to rest mainly on strong global demand for AI hardware.

Is Nvidia Stock a Buy?

Nvidia continues to hold the Street’s endorsement with a Strong Buy consensus rating. The average NVDA price target is $231.34, implying an 11.74% upside from the current price.