Cryptocurrency mining firm American Bitcoin, which is backed by U.S. President Donald Trump’s two oldest sons, Eric Trump and Donald Trump Jr., is set to go public on the Nasdaq exchange in an all-stock merger with Gryphon Digital Mining (GRYP).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares of GRYP are up more than 200% on news of the combination. Once the transaction is complete, the newly combined company will be known as American Bitcoin and will trade on the Nasdaq Composite index under the ticker symbol “ABTC.”

The deal that will take American Bitcoin public is expected to close in the third quarter of this year. Existing shareholders of American Bitcoin, including the president’s sons, will own about 98% of the new company. Gryphon Digital trades as a penny stock, defined as any security with a share price below $5.

High-Profile Move

Taking American Bitcoin public is the latest high-profile move in the cryptocurrency sector by the Trump family. In addition to American Bitcoin, the U.S. president’s family has a $TRUMP meme coin that is offering a private dinner with the president to top holders of the digital token.

Eric Trump, who is co-founder and chief strategy officer of American Bitcoin, framed the move as part of a broader plan to cement America’s leadership in the global race to mine Bitcoin (BTC). During his election campaign last year, President Trump promised to support U.S.-based Bitcoin miners, telling executives at a closed-door event that he wants all future Bitcoin minted on American soil.

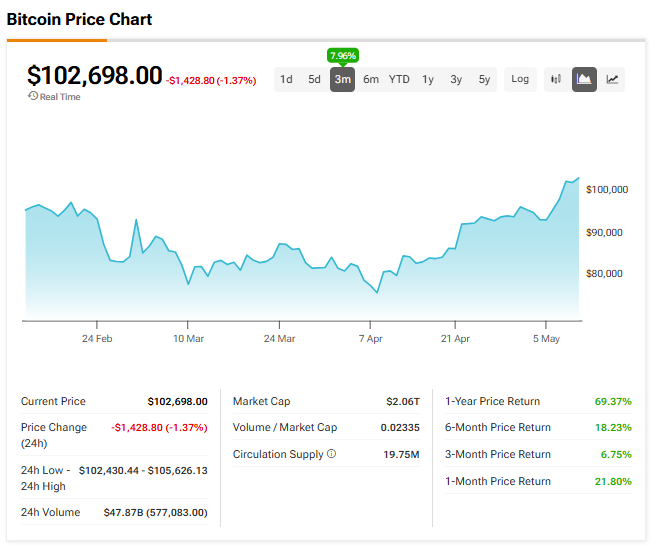

Bitcoin is trading around $102,700, having gained 10% this year.

Is BTC a Buy?

Most Wall Street firms don’t offer ratings or price targets on Bitcoin, so we’ll look at the cryptocurrency’s three-month performance instead. As one can see in the chart below, the price of BTC has risen 7.96% in the last 12 weeks.