Washington is moving from grants to ownership. Several quantum-computing companies are in talks with the Commerce Department to exchange federal funding for equity stakes. The discussions involve IonQ (IONQ), Rigetti Computing (RGTI), and D-Wave Quantum (QBTS). In addition, Quantum Computing Inc. (QUBT) and Atom Computing are weighing similar terms.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Executives familiar with the talks say the government is discussing minimum awards of 10 million dollars per company. Other technology names are expected to apply as the program opens wider. Moreover, the transaction structures could include warrants, IP licenses, royalties, or revenue sharing alongside straight equity.

Policy Extends Equity-for-Aid Playbook

The move follows a series of high-profile interventions. In August, the government agreed to convert nearly 9 billion dollars of Intel (INTC) grants into equity representing close to 10 percent of the chipmaker. The Energy Department also received warrants tied to a lithium startup in exchange for a loan. The same logic applies here. If taxpayers fund critical industries, the government wants to share in the upside.

President Trump and Commerce Secretary Howard Lutnick have both argued for this approach. The strategy gives Washington a direct financial stake while signaling which firms it views as strategically important.

Quantum Builds a Case for Direct Support

Quantum hardware can solve classes of problems that overwhelm classical machines. Faster search for new drugs, materials, and catalysts sits at the top of the list. That promise has drawn heavy investment from IBM, Microsoft, and Google. On Wednesday, Google said it ran a quantum workload 13,000 times faster than top supercomputers. Meanwhile, China continues to spend aggressively in the field.

Deputy Commerce Secretary Paul Dabbar is leading the talks. He previously worked in quantum and at the Energy Department. A Commerce official said Bohr Quantum Technology, which Dabbar co-founded, is not a candidate for funding.

Companies Position for Capital and Contracts

Rigetti said it continues to engage the government on funding opportunities. D-Wave said it aims to sell systems that solve difficult public-sector problems and deliver a return. Quantum Computing Inc. called potential equity stakes exciting. Atom Computing and IonQ declined comment.

The money would come from the Chips Research and Development Office. Secretary Lutnick recently reorganized that unit and redirected funds from earlier initiatives. In addition, the agency’s application documents outline flexible deal mechanics, so terms could change before signing.

What Investors Should Watch

Investors should track three items. First, the size and form of any equity or warrant package. Second, procurement momentum tied to government use cases. Third, the pace of standard-setting as regulators refine how quantum systems are validated and deployed. If funding closes and contracts follow, the sector’s recent pullback could reset into a new capital cycle.

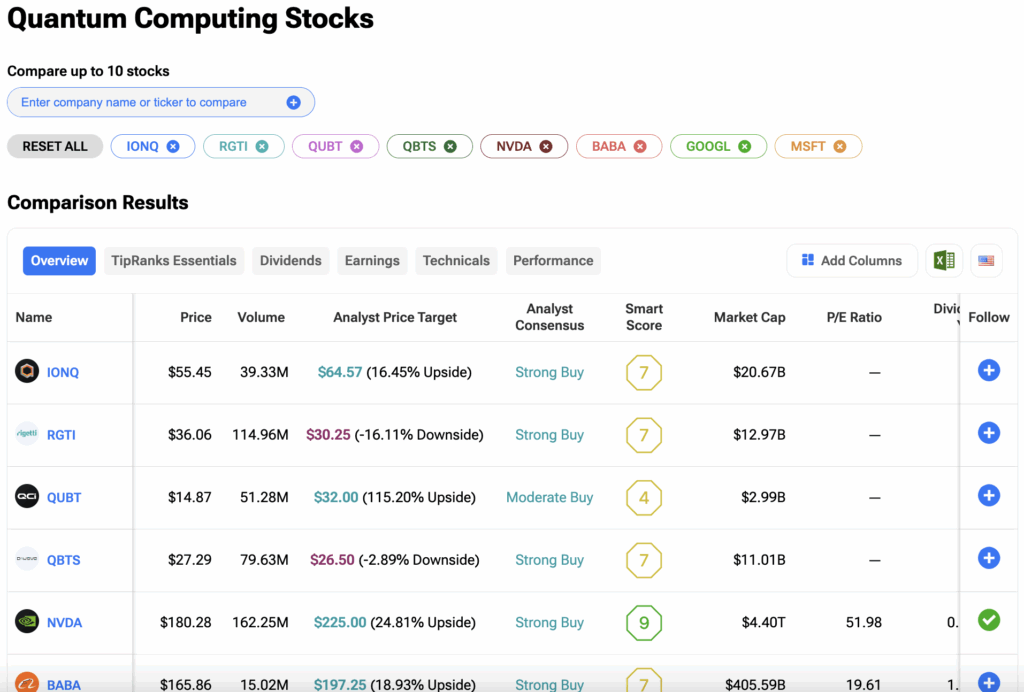

Investors can also compare Quantum Computing stocks side-by-side based on various financial metrics and analyst ratings on the TipRanks Stocks Comparison tool. Click on the image below to explore the tool.