The administration of U.S. President Donald Trump is denying plans to take equity stakes in quantum computing firms such as D-Wave Quantum (QBTS), Rigetti Computing (RGTI), and IonQ (IONQ).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earlier media reports said that the Trump administration was interested in taking equity stakes in quantum computing firms, similar to the position it took in microchip designer Intel (INTC) earlier this year. Quantum stocks had risen sharply on the previous media reports.

Specifically, there were reports that D-Wave, Rigetti, and IonQ were in discussions about granting shares to the U.S. Commerce Department in exchange for minimum funding awards of $10 million each. However, the Commerce Department is denying having any interest in quantum computing.

No Negotiations

The Commerce Department said in a statement that it is “not currently negotiating equity stakes with quantum computing companies.” However, when justifying the 10% stake that the U.S. government took in Intel, Commerce Secretary Howard Lutnick said that American taxpayers should benefit from a company’s success, especially where federal funds are involved.

D-Wave’s stock saw the biggest gain on Oct. 23 when reports of a potential government stake surfaced, rising 14%. Rigetti and IonQ stocks rose 8% and 7%, respectively. While those gains have been pared after the Commerce Department denied interest in the quantum computing companies, the stocks are still up on the day, with D-Wave’s shares trading 12% higher at mid-afternoon.

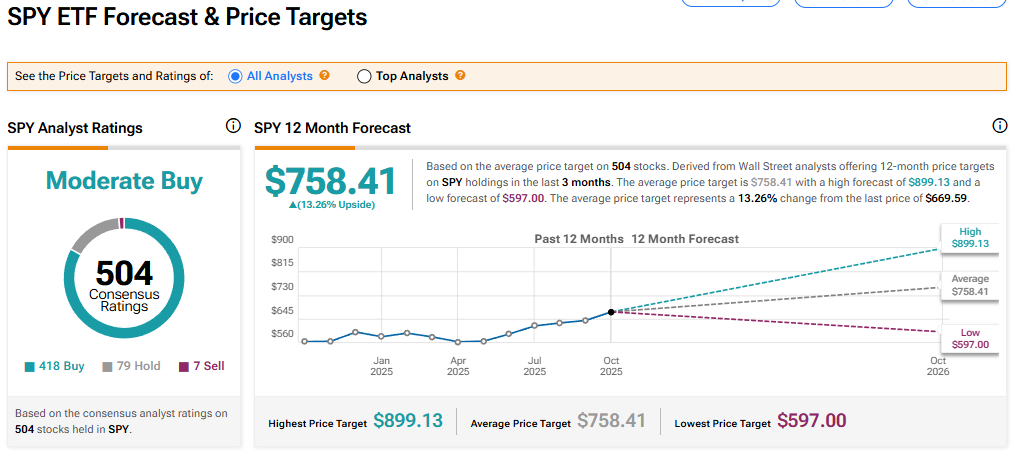

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 418 Buy, 79 Hold, and seven Sell recommendations issued in the last three months. The average SPY price target of $758.41 implies 13.26% upside from current levels.