Truist Financial (NYSE:TFC) shares surged over 3% in the early session today after the bank announced its fourth-quarter results. While revenue declined by 8% year-over-year to $5.76 billion, the figure still outpaced expectations by $60 million. In sync, EPS of $0.81 exceeded estimates by $0.13. Truist had generated an EPS of $1.20 in the comparable year-ago period.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, net interest income decreased to $3.6 billion from $4.03 billion a year ago. Similarly, noninterest income dropped to $2.16 billion from $2.23 billion in the prior year period. For the full year, total revenue ticked up to $23.61 billion from $23.18 billion in 2022. The company recorded a non-cash goodwill impairment charge of $6.1 billion and costs of $507 million from the special FDIC assessment during this period.

However, its adjusted noninterest expense declined by 4.5%, pointing to lower personnel expenses. Net interest margin for 2023 came in at 3% compared to 3.01% in 2022. At the same time, Truist’s provision for credit losses shot up to $572 million in Q4 from $467 million in the comparable year-ago period.

Is TFC a Good Stock to Buy?

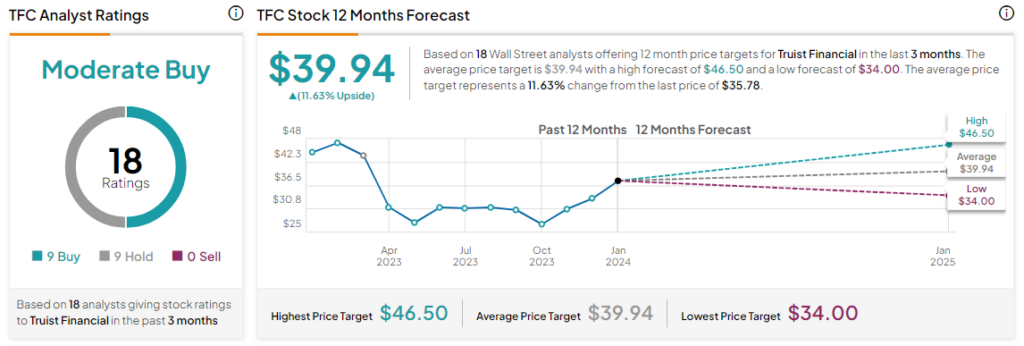

Overall, the Street has a Moderate Buy consensus rating on Truist Financial, and the average TFC price target of $39.94 implies a modest 11.6% potential upside in the stock. That’s after a nearly 7% rise in the company’s share price over the past six months.

Read full Disclosure