Tripadvisor (NASDAQ:TRIP) stock gained over 12% in yesterday’s extended trading session after the online travel company reported upbeat third-quarter results. TRIP benefitted from increased consumer spending on its online experience platform, Viator, and core hotel meta offerings.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Q3 adjusted earnings climbed 37% year-over-year to $0.52 per share and surpassed the analysts’ estimate of $0.47. Meanwhile, the company reported revenue of $533 million, which climbed over 16% from the prior-year quarter. The figure also came above the consensus estimate of $505 million.

Segment-wise, TRIP witnessed top-line growth in all its divisions: Tripadvisor Core, Viator, and The Fork. It is worth mentioning that most of the growth was contributed by the Viator division, which witnessed a 33% year-over-year jump in gross bookings.

Following the Q3 earnings release, Bernstein analyst Richard Clarke reiterated a Buy rating on the stock with a price target of $14.80 (8.1% downside potential).

Is TRIP a Good Stock to Buy?

The company’s recent strategic efforts, such as new feature enhancements and expanding its customer data platform, highlight its commitment to providing personalized travel recommendations to users. However, intense competition in the travel industry remains a key concern.

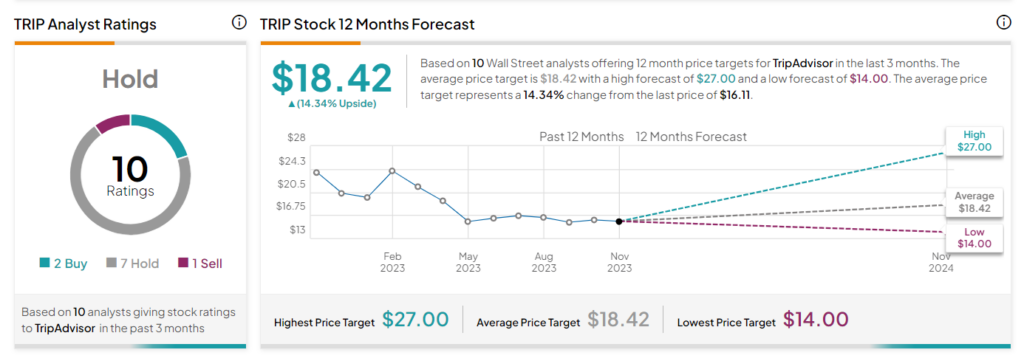

On TipRanks, TRIP has a Hold consensus rating based on two Buys, seven Holds, and one Sell. The average Tripadvisor stock price target of $18.42 implies 14.34% upside potential. The stock is down 12% so far in 2023.