China-based travel services company Trip.com (TCOM) is preparing to release its earnings report for the third quarter of 2024 before markets open on Monday. Wall Street estimates earnings per share of $0.96 for this period. Analysts are also looking for revenue to come in at $2.16 billion, based on the latest TipRanks Forecast data.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Will Trip.com Surpass Wall Street Estimates?

There’s strong evidence that Trip.com will beat out analysts’ estimates for Q3 2024. The company’s earnings history shows it has come in above Wall Street’s EPS estimates for the past eight quarters. Its revenue matched estimates in the previous quarter and beat them in the seven quarters prior to that.

Adding to this is the travel company’s website performance for Q3. Traffic on Trip.com’s website has increased 77.31% when compared to the third quarter of 2023. This suggests that the company will likely report strong earnings data in its upcoming report.

According to TipRanks’ Bulls Say, Bears Say tool, Chinese travel policies could be a big boost to its business in Q3. The reason behind this is the country’s introduction of 15-day visa-free policies for nine countries. This should result in increased travel to China. That matters to TRIP as it is a leader in the country’s travel market with a dominant share and price leadership.

Should Investors Buy TCOM Stock?

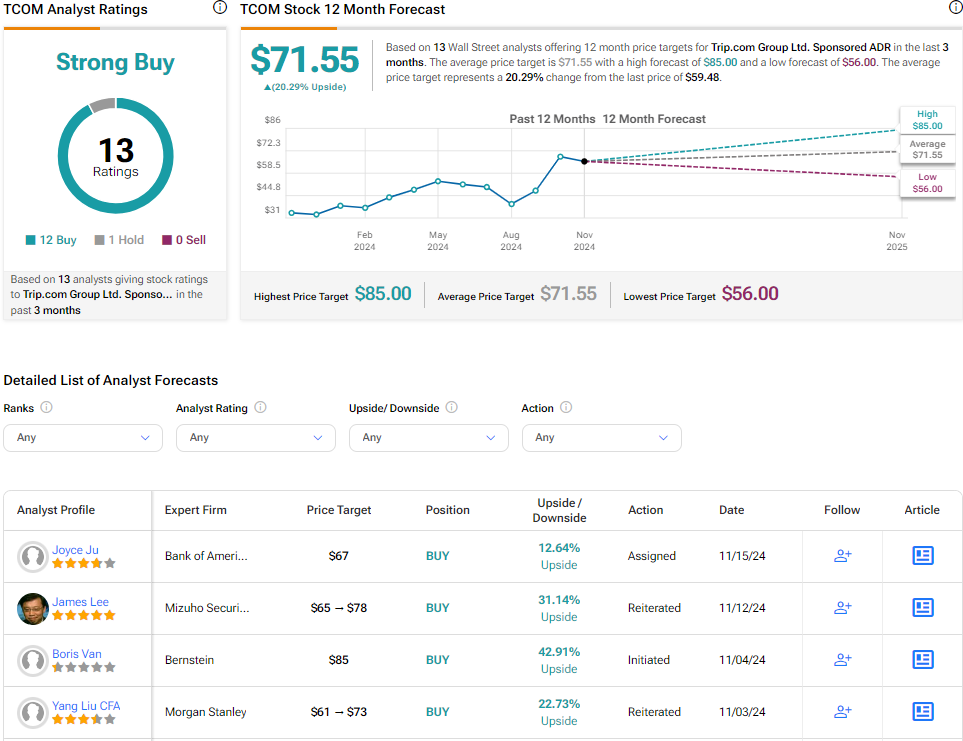

Turning to Wall Street, analysts have a Strong Buy rating for TCOM stock based on 12 Buys and one Hold over the last three months, as shown in the following graph. Investors will note that the analysts’ average price target for Trip.com shares is sitting at $71.55. That represents a potential upside of 20.3% for the stock. It’s also worth keeping in mind that TCOM is up 66% year-to-date and 69% over the past 12 months.