President Donald Trump has remained a polarizing figure throughout his political career. At the same time, his intensely loyal base has been a key driver of the market value behind Trump Media & Technology Group (DJT), better known as “Truth Social.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Under different circumstances, the company’s social media platform would amass a handful of users and become a niche player. However, its association with Donald Trump has given the social media outlet an outsized presence and influence. Meanwhile, an increasing number of people are becoming aware of the brand, as the U.S. President continues to transform negative publicity into greater popularity.

As a company, DJT offers investors a promise-rich long-term opportunity to gain exposure to emerging market themes, such as cryptocurrency. Unfortunately for longtime believers, clout alone hasn’t been enough to prop up the struggling enterprise.

Since January, DJT stock has declined by almost 45%. It has also gone backwards over the past 52 weeks, shedding approximately 36%. While Trump himself may be winning, the security that bears his name isn’t. Still, the red ink just might open an opportunity for speculative options traders.

No doubt, DJT stock is wildly risky. At the same time, the fundamental narrative is compelling. At least for the next three years (and possibly beyond), Truth Social will be the go-to source for wild soundbites and other clues regarding domestic and foreign policies. Therefore, it’s a reasonable time to be Bullish on DJT, with a specific strategy in mind.

Perhaps most importantly from a trading perspective, investors tend to buy when the market dips. With DJT stock suffering an extended period of volatility, this could be an ideal time to strike.

A Thought Experiment to Get the Ball Rolling

In recent months, I’ve explored the topic of using statistical analysis to frame the decision-making process for options trading. Unfortunately, both statistics and options are complex topics in their own right. By mixing the two, the complexity is further aggravated. Finally, though, I believe I have found a workable solution in the form of a thought experiment.

Suppose you flip a (fair) coin 100 times each day, Monday through Friday. As you know, coin tosses are purely random. Thus, whatever you flipped on Monday tells you absolutely nothing about what you’ll flip on Tuesday. There’s no memory, no bias, no structure — just pure randomness.

Imagine, though, if the stock market were also random. Using a similar example, you could buy a stock on Monday morning and sell it that afternoon. Whatever happened on that day should have zero bearing on Tuesday’s results. Furthermore, if you ran this experiment over select time intervals over 20 years, for instance, the long-side success ratio would be roughly the same: around 50%.

By logical deduction, if the market were truly random, there would be zero incentive to pay attention to any news or to perceive any patterns on the charts. However, that’s not how markets work, and this is where statistical analysis comes into play.

Statistical Analysis Spots Clear Opportunity

Having established that the market is not random, the next task is to find meaningful, empirically validated patterns. Here, technical analysis may seem like an obvious answer, but the discipline tends to devolve into post-hoc rationalizations.

We need something more tangible, which is why I prefer converting price action into market breadth or sequences of accumulative and distributive sessions.

As a representation of demand, market breadth is effectively binary — the market is either a net buyer or a net seller. Through this binary classification, it’s easier to segregate demand profiles into distinct behavioral states. Using past analogs, we can calculate the likelihood of transition from one state to another, as well as how the market responds to the emergence of specific profiles.

Let’s look at a real-world example. In the past two months, the price action of DJT stock can be converted as a “2-8-D” sequence: two up weeks, eight down weeks, with a negative trajectory across the 10-week period. Admittedly, this conversion process reduces DJT’s magnitude dynamism into a simple binary code. However, the benefit is that we can now assess forward probabilities.

If the market were random, whether DJT flashed a 2-8-D or a 6-4-U or whatever wouldn’t matter; we would expect the same success ratio of around 50%. The thing is, when the 2-8-D flashes, the next week’s probability is 60%, not 50%. Plus, the median return stands at 1.7%.

Should the bulls maintain control for a second week, the median return is 8.06%. That should have speculators thinking.

Setting Up a Bullish Trade for Trump Media

Based on the market intelligence above, the 19/20 bull call spread expiring July 25 may be the most rational. This transaction involves buying the $19 call and simultaneously selling the $20 call, resulting in a net debit paid of $52 (the maximum loss that can be incurred in the trade). Should DJT stock rise through the short strike price of $20 at expiration, the maximum reward is $48, a payout of over 92%.

Those who are really feeling frisky may consider the 19.50/20.50 bull spread, also expiring July 25. This trade features a cheaper net debit of $42, but with a maximum reward of $58, or a payout exceeding 138%. However, reaching $20.50 is going to be a stretch percentage-wise.

Either way, what makes these transactions compelling is the implied shift in the sentiment regime of the 2-8-D sequence. As a baseline, the chance that a long position in DJT stock will be profitable is only 45.69%. Therefore, the 2-8-D flashing tilts the odds in favor of the bulls when it otherwise would favor the bears.

What do the Hedge Funds Think About DJT?

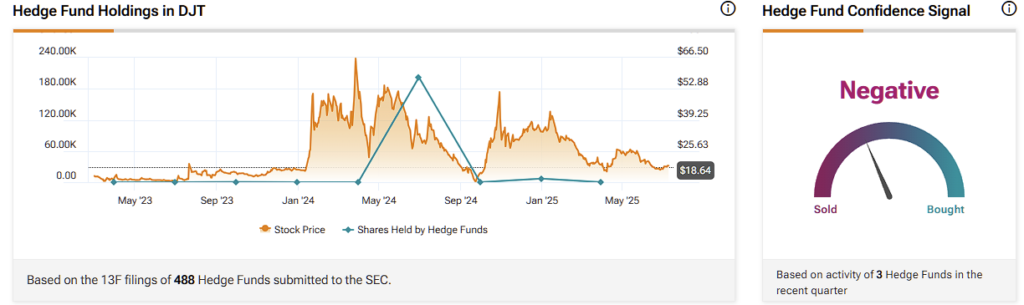

Despite its headline-grabbing exploits, the smart institutional money is apprehensive about DJT. According to TipRanks’ hedge fund tracker, DJT is currently seen with low confidence by hedge fund managers on Wall Street.

Based on 13F filings from 488 hedge funds submitted to the U.S. SEC throughout 2025, hedge fund managers have reduced their stakes from around 180,000 shares in August 2024 to almost zero in September 2024. The most notable shareholders currently are GoalVest Advisory and Fortitude Family Office.

Despite DJT’s share price rising as high as $52 per share since, hedge funds have not touched DJT stock. The current Confidence Signal based on three leading hedge funds is Negative.

Speculative Traders Buy the Dip Despite DJT’s Struggles

Although President Trump has achieved numerous successes in the political realm, his Truth Social platform hasn’t been as fortunate, at least not in the market. Despite its underwhelming performance, investors will still choose to step in and buy the dip in Truth Social — which provides potential options market opportunities for short-term traders. Although picking market bottoms can be fruitful, caution remains essential.