The Trade Desk (NASDAQ:TTD) soared in pre-market trading after the company announced stellar fourth-quarter results and upbeat guidance. The technology platform for buyers of advertising saw its revenues increase by 23% year-over-year to $606 million, exceeding consensus estimates of $486.9 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company reported adjusted earnings of $0.41 per share in Q4, up by 7.9% year-over-year, in line with consensus estimates.

Trade Desk’s Board of Directors approved a stock buyback of an additional $647 million. The company’s share buybacks totaled $220 million in the fourth quarter.

For the first quarter, TTD projected revenues of at least $478 million, with adjusted EBITDA likely to be around $130 million. This is above analysts’ projections of revenues of $478 million.

What is the Future of TTD Stock?

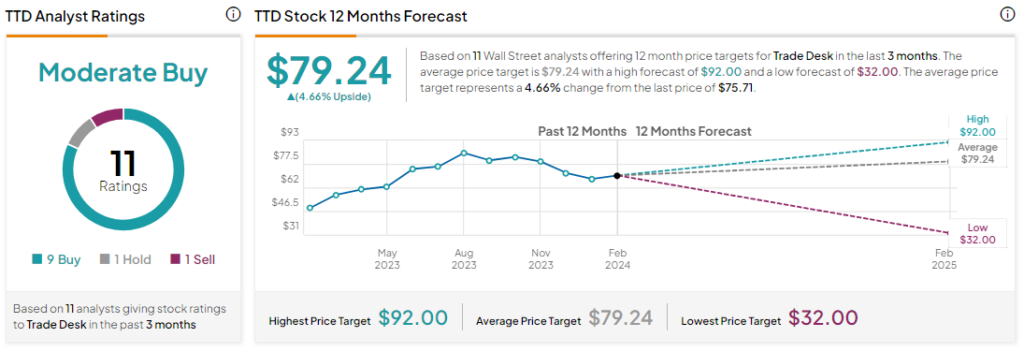

Analysts remain cautiously optimistic about TTD stock, with a Moderate Buy consensus rating based on nine Buys and one Hold and Sell each. TTD stock has gone up by more than 15% over the past year, and the average TTD price target of $79.24 implies an upside potential of 4.6% at current levels.