Tractor Supply (NASDAQ:TSCO) is changing its strategy to refocus on its core rural market. It is shifting away from its corporate diversity and environmental initiatives.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Tractor Supply is a retailer that sells products catering to rural America. Most of its customers reside in rural areas with conservative values.

In a recent statement, TSCO said that it is discontinuing its diversity, equity, and inclusion (DEI) goals. Further, it is withdrawing its carbon-emission reduction targets. Also, it would stop sponsoring non-business activities such as pride festivals.

The Reason for This Change

The company cited customer feedback as the reason behind these changes. According to a Wall Street Journal report, Tractor Supply faced pressure from conservative activists. These activists criticized the company’s DEI efforts on social media platforms. Some even threatened to boycott the brand.

This echoes a similar situation with Anheuser-Busch InBev’s (NYSE:BUD) Bud Light brand. The beer brand faced backlash for its partnership with a transgender influencer. This move led to a significant drop in sales for the Bud Light brand. Bud Light lost the spot as America’s top-selling beer.

TSCO: Refocusing on Core Rural Priorities

Tractor Supply will concentrate on core rural priorities. These include agricultural education, land and water conservation, animal welfare, and veteran support, among others. Its pivot reflects a response to its customers’ values and feedback. The company aims to strengthen its core market by refocusing on rural priorities.

The company is witnessing a recovery in demand for big-ticket items. In addition, its total customer count increased during the first quarter. Overall, its focus on customer feedback, demand recovery, and cost reduction initiatives supported its earnings and share price.

TSCO stock is up over 25% year-to-date, outperforming the S&P 500’s (SPX) nearly 15% gain.

Is TSCO a Good Stock to Buy?

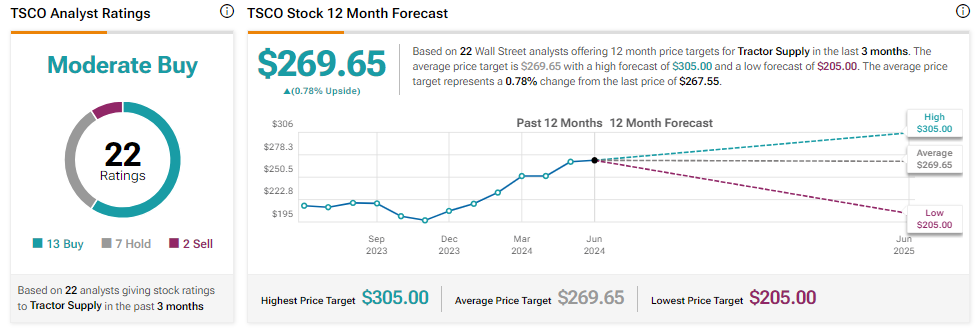

Wall Street is cautiously optimistic about TSCO stock. With 13 Buys, seven Holds, and two Sell recommendations, TSCO stock has a Moderate Buy consensus rating. The analysts’ TSCO stock price target is $269.65, implying 0.78% upside potential from current levels.