Toyota’s (TM) shares trended near the flat line during pre-market trading on Tuesday as activist investor Elliott Investment Management disclosed it has taken a significant stake in the Japanese automobile manufacturer’s subsidiary, Toyota Industries (TYIDF).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Toyota Industries is Toyota’s machine-making unit that produces forklift trucks used in factories and other industrial manufacturing environments to move objects. The subsidiary also manufactures vehicle parts.

Elliott did not specify the amount or the percentage of its stake in the subsidiary. However, Toyota Industries, in a filing made on Tuesday, disclosed that Elliott owned 3.26% of the machine-making unit, as of September 30.

Investors Criticize Toyota’s Plan to Take Subsidiary Private

The hedge fund’s stake follows Toyota’s efforts to take the subsidiary private in a $31 billion deal that has attracted criticism from investors. A group of investors around mid-October picked holes in the deal, noting that the proposed acquisition lacked transparency and meaningful disclosure.

When the proposal first emerged in June, it was also greeted with skepticism, with some investors noting the offer undervalues Toyota Industries. Disclosing its stake on Tuesday, Elliott reiterated these points, noting that it has been engaging with the management and board of the subsidiary about the take-private arrangement.

Toyota Industries was founded by Sakichi Toyoda, the father of Toyota Motor founder Kiichiro Toyoda. The business initially focused on the production of automatic looms used in cloth weaving, but later expanded into the production of forklift trucks.

Toyota CEO Eyes More Control over Toyota Industries

As a legacy business, Akio Toyoda, Toyota’s current chairman and Kiichiro’s grandson, is seeking to expand his family’s control of the business. He plans to personally invest over $6.7 million into the deal.

Akio plans to make Toyota Industries private through a holding company that will consist of Toyota and Toyota Fudosan, Toyota’s unlisted real estate unit. However, progress on the process has been delayed until February 2026 due to regulatory impediments across several jurisdictions.

Is TM Stock a Buy?

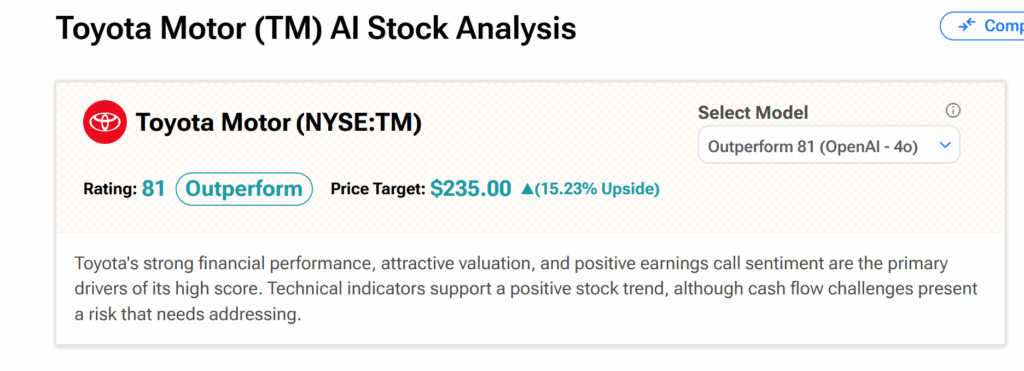

TipRanks’ AI Stock Analysts across models such as OpenAI, Gemini, Grok, and DeepSeek, all currently rank Toyota shares as Outperform. For instance, OpenAI-4o currently rates the stock with a score of 81 out of 100 due to its strong financial base and valuation.

The average TM price target of $235 from this model suggests a potential upside of about 15%.