Japan-based Toyota Motor Corporation (JP:7203) (TM) announced its monthly numbers for August 2024, reporting a slump in its output due to the ongoing pressures in China and Japan. The company’s global sales fell 3.7% year-on-year in August 2024 after a gain of 0.7% in the previous month. Additionally, Toyota’s global production, including subsidiaries Daihatsu Motor and Hino Motors, declined 12.6% in August compared to the previous year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Toyota shares in Hong Kong gained 2.04% today.

Toyota Faces Production Setbacks

Toyota’s’ production was disrupted by domestic scandals in Japan and growing competition in China.

In Japan, the company’s sales dropped 9.6%, impacted by the delayed fallout from regulatory scandals involving false safety certifications. These issues led several major carmakers to halt production for certain models. Moreover, the company had to halt operations at all its factories in Japan as a powerful typhoon approached the country’s southern island.

Speaking of China, Toyota’s sales dropped 13.5% to 152,065 units in August. An ongoing price war and fierce competition with players such as BYD Co. (HK:1211) pose a further threat to its market share. Earlier in September, Nikkei Business reported that Toyota reduced its global EV production forecast for 2026 by one-third. The company now aims to produce 1 million EVs by 2026, down from its earlier estimate of 1.5 million.

On the bright side, the demand for its hybrid gas-electric vehicles has stabilized. It sold 336,848 hybrids during August, marking a 22% increase compared to last year.

Are Toyota Shares a Good Buy?

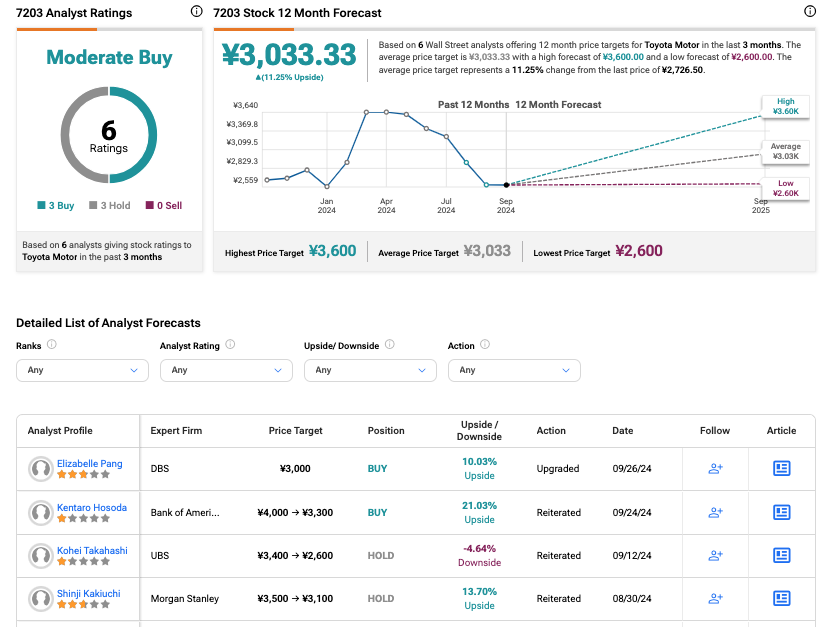

On TipRanks, 7203 stock has received a Moderate Buy rating based on three Buy and three Hold recommendations. The Toyota share price target is ¥3,033.33, which implies a growth rate of 11.25% on the current levels.