Topgolf Callaway Brands’ (MODG) board has decided to split the company into two separate businesses following its strategic review. The board and management made this decision to maximize shareholder value. Interestingly, the move comes less than four years after Topgolf and Callaway combined and took the current name.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The separation is expected to be completed in the second half of 2025, subject to closing conditions. Following the news, MODG shares rose over 2% in Wednesday’s after-hours trading.

MODG Offers Details About the Split

Topgolf Callaway’s board has decided to keep the Callaway golf equipment and apparel business under one unit. Callaway earned $2.5 billion in sales over the last 12 months through Q2 2024. Meanwhile, Topgolf, which operates state-of-the-art golf courses and generated $1.8 billion in sales over the same period, will run as an independent company.

The board is yet to decide on the actual course of the separation, but views a spin-off as one of the most viable options. According to current discussions, MODG will spin off at least 80.1% of Topgolf to secure a tax-free treatment. The company will continue to hold the remaining minority interest for a few years. Following the split, Callaway will carry all the existing debt of the combined company except for the venue financing obligations that are specific to Topgolf’s business.

The two companies will continue pursuing ongoing commercial agreements. Also, Callaway will remain the exclusive golf equipment partner for Topgolf.

Rationale Behind Topgolf Callaway’s Split

Commenting on the rationale behind the split, CEO Chip Brewer stated that the two businesses have unique operating models and capital structures. Furthermore, the separated companies will be able to better focus on their industry-leading market positions, undertake appropriate capital investment initiatives, create simplified operating structures, and present different and compelling investment opportunities for investors.

Brewer will continue to be the CEO of Callaway, while Artie Starrs will continue to lead Topgolf.

Brewer also added that the company has invested heavily to expand the scale and profitability of Topgolf since its acquisition in 2021. This has even helped Topgolf to exceed growth expectations over the years, which the independent company can leverage going further. At the same time, Callaway already maintains the #1 position in the U.S. market for golf clubs and the #2 position in golf balls.

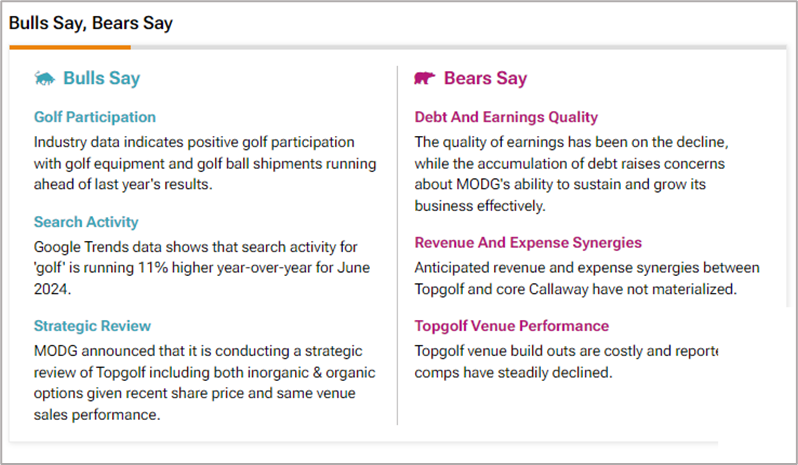

Insights from TipRanks’ Bulls Say, Bears Say Tool

The news about the split comes at a time when some analysts have already raised concerns about the synergistic benefits from the 2021 Callaway and Topgolf merger, as indicated by TipRanks’ Bulls Say, Bears Say tool. Bears are even concerned about MODG’s rising debt, declining quality of earnings, growth prospects, and increased expenses for Topgolf’s venue build-outs.

On the other hand, Bulls are encouraged by the positive industry trends for golf participation and equipment and the increasing search activity for “golf” on Google Trends. Moreover, analysts were hoping to see positive outcomes from the management’s strategic review of Topgolf.

Is Topgolf Callaway a Buy?

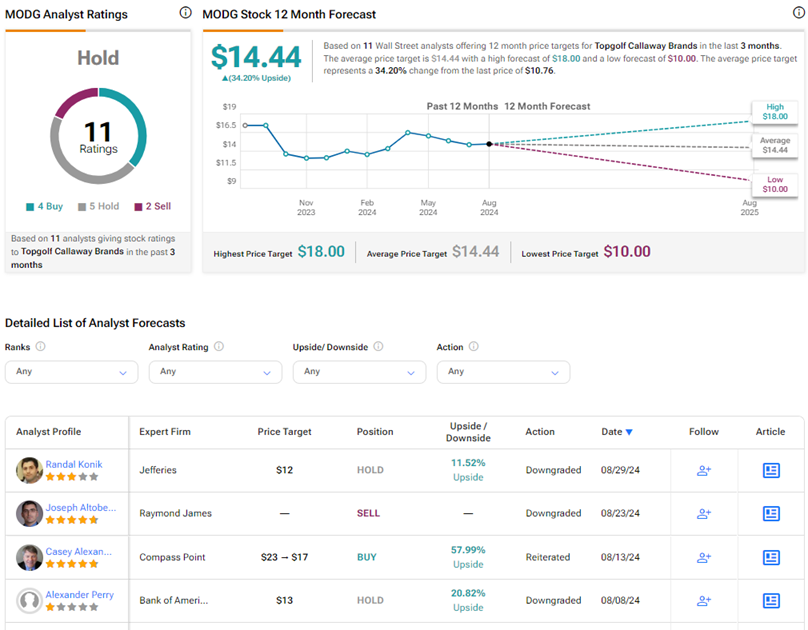

Given the conflicting views of analysts, MODG stock has a Hold consensus rating based on four Buys, five Holds, and two Sells. The average Topgolf Callaway Brands price target of $14.44 implies 34.2% upside potential from current levels. MODG shares have lost nearly 25% of their value so far this year.

It is important to note that these ratings and price targets could change as analysts review MODG’s strategy to split the company.