Streaming giant Netflix (NFLX) is scheduled to announce its second-quarter results on Thursday, July 17. Ahead of the results, Alicia Reese, a top analyst from Wedbush, reiterated a Buy rating on NFLX stock with a price target of $1,400. The analyst highlighted the company’s ability to boost its ad-tier revenue and other positives.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Meanwhile, Wall Street expects Netflix to report Q2 earnings per share (EPS) of $7.07, reflecting a 45% year-over-year growth. Revenue is expected to rise 15.5% to $11.04 billion.

Top Analyst Is Bullish on Netflix’s Prospects

Reese believes that Netflix is well-positioned to accelerate its ad-tier revenue contribution over the next several years through multiple initiatives, including adding and improving live events, and enhancing its advertising solutions and targeting capabilities. She also expects NFLX’s ad revenue to gain from additional partnerships and broadening of its content strategy.

The 5-star analyst stated that while impressive subscriber growth was the primary driver of Netflix’s performance last year, she expects price hikes to fuel revenue growth in 2025. Reese expects the company’s ad tier to drive top-line growth in 2026. Furthermore, Reese believes that as Netflix expands, its contribution margin can significantly surpass Wedbush’s estimates and drive “outsized” free cash flow.

Reese ranks 620 out of more than 9,800 analysts tracked by TipRanks. She has a success rate of 66%, with an average return per rating of 17.9% over a one-year period.

Aside from Reese, several analysts have recently reiterated their Buy rating on NFLX stock, expressing confidence about Netflix’s upcoming Q2 results and the company’s growth potential. Last week, KeyBanc analyst Justin Patterson increased the price target for Netflix stock to $1,390 from $1,070 and reaffirmed a Buy rating. The 5-star analyst expects the company to deliver low-double-digit revenue growth over the medium term and EPS of nearly $40 by 2027, driven by live events, price increases, and an ad ramp.

However, Patterson thinks that Netflix stock’s strong year-to-date rally (up 42%) could create some volatility, as investors await the next hit following the success of Wednesday and Stranger Things.

Is NFLX Stock a Buy Right Now?

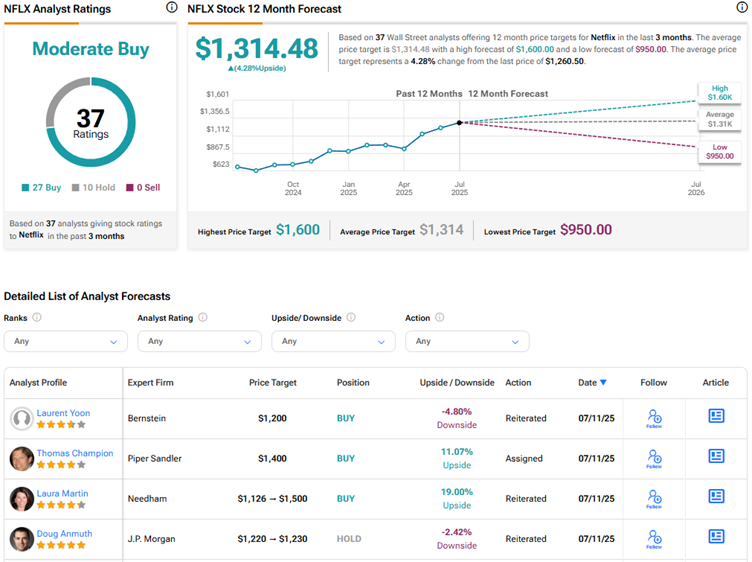

With 27 Buys and 10 Holds, Netflix stock scores a Strong Buy consensus rating on TipRanks. The average NFLX stock price target of $1,314.48 implies 4.3% upside potential from current levels.