Advanced Micro Devices (AMD) sparked a wave of bullish sentiment when it inked a landmark agreement with OpenAI (PC:OPAIQ) to provide 6 GW of compute infrastructure over five years. The deal is being hailed by top Wall Street analysts as a validation of AMD’s AI roadmap, putting the company in a leading spot in the growing AI market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Jefferies Says OpenAI Deal Validates AMD’s AI Ambitions

Top Jefferies analyst Blayne Curtis upgraded AMD from Hold to Buy and raised his price target to $300, up from $170. Curtis said the firm “rarely” issues upgrades so soon after a previous estimate change, but the scale of the OpenAI agreement warranted an exception.

He said Jefferies had already raised its estimates last week after strong server checks but still found it hard to gauge how big AMD’s AI opportunity could be. The OpenAI deal, which includes plans to buy about 6 GW of AMD equipment worth $80 billion to $100 billion, has now made that clearer.

Curtis called the partnership a strong vote of confidence in AMD’s AI plans and proof of rising demand for its chips. He added that while AMD still needs to meet key goals, the agreement shows the company is becoming a bigger force in the fast-growing AI chip market.

UBS and Evercore See Big Upside after OpenAI Deal

Top UBS analyst Timothy Arcuri raised his price target on AMD to $265 from $210 and kept a Buy rating. He said AMD’s five-year, 6 GW deal with OpenAI shows growing trust in the company’s AI chips and roadmap. He believes this deal could help AMD win close to one-third of the GPU market, a much bigger share than most expected. Acuri added that the deal shows how fast spending on AI hardware is likely to grow in the next few years.

Similarly, Evercore ISI analyst Mark Lipacis also raised his price target on the stock to $240 from $188 and kept an Outperform rating. He said the OpenAI deal could lift AMD’s earnings by more than $2 per share in 2027 and over $4 in 2028. Lipacis called the partnership a clear vote of confidence in AMD’s chip design and said it could help the company win more business from big cloud customers in the future.

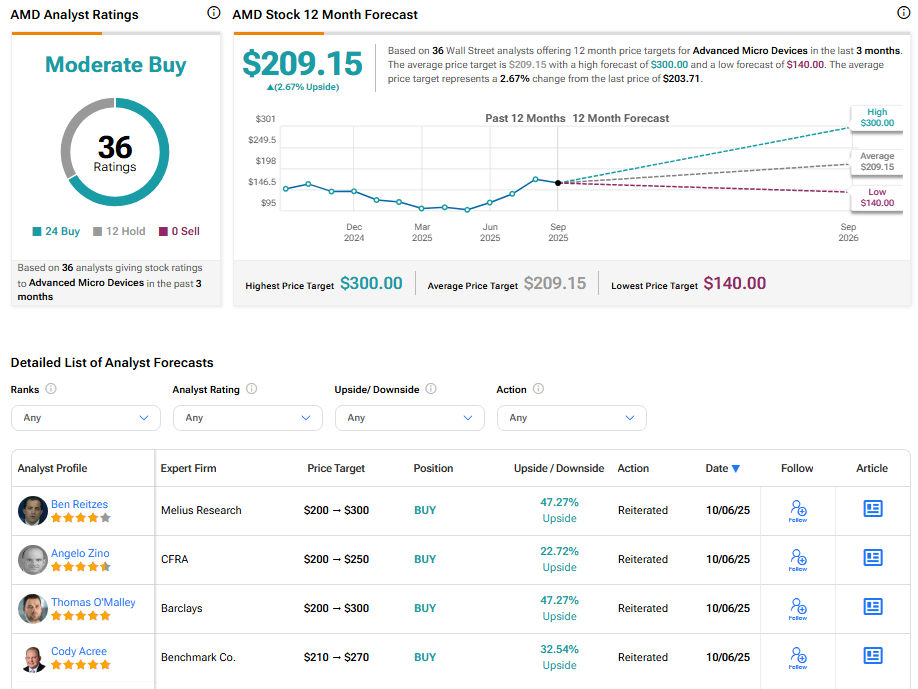

Is AMD Stock a Buy, Sell, or Hold?

Currently, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 24 Buys and 12 Holds. The average AMD stock price target of $209.15 indicates about 2.67% upside potential.