Life sciences group Repligen (RGEN) is set for healthy revenue growth, boosted by its “underappreciated” AI capabilities.

Four-star TipRanks-rated Brendan Smith, analyst at TD Cowen, has initiated coverage of the stock with a Buy rating and a $200 price target. That compares with its closing share price on Friday of $156.05. Smith said the company was a “top-tier tools name for today and tomorrow” and was well positioned for “industry-leading” growth and margin expansion. That’s because of its exposure to new modalities such as gene therapies and viral vectors. According to Boston Consulting Group new drug modalities represented $168 billion in projected pipeline value in the overall industry in 2024, up 14% on 2023.

Shields Against China and NIH Headwinds

Smith also likes Repligen’s limited exposure to National Institutes of Health funding and China, which, he added, should shield them from the near-term sector headwinds facing their peers. In addition, he praised its bioprocessing solutions such as chromatography, advanced filtration, and process analytics which “drive efficiency and scalability to replace legacy methods and outperform peers.” Indeed, Smith said Repligen’s AI efficiencies are “underappreciated.”

Future Revenues Looking Robust

Differentiated product offerings combined with a strong track record of innovation and strategic acquisitions position the group, he added, for sustained revenue expansion above its peers. In terms of numbers, he is modeling +10% revenue growth in full year 2025, expanding to 15% within the next two to three years. “Repligen deserves a premium valuation relative to peers more reliant on legacy biologics and vulnerable to external market pressures,” he concluded.

The note did little however to perk up RGEN stock which was just 0.36% higher in pre-market trading.

Is RGEN a Good Stock to Buy?

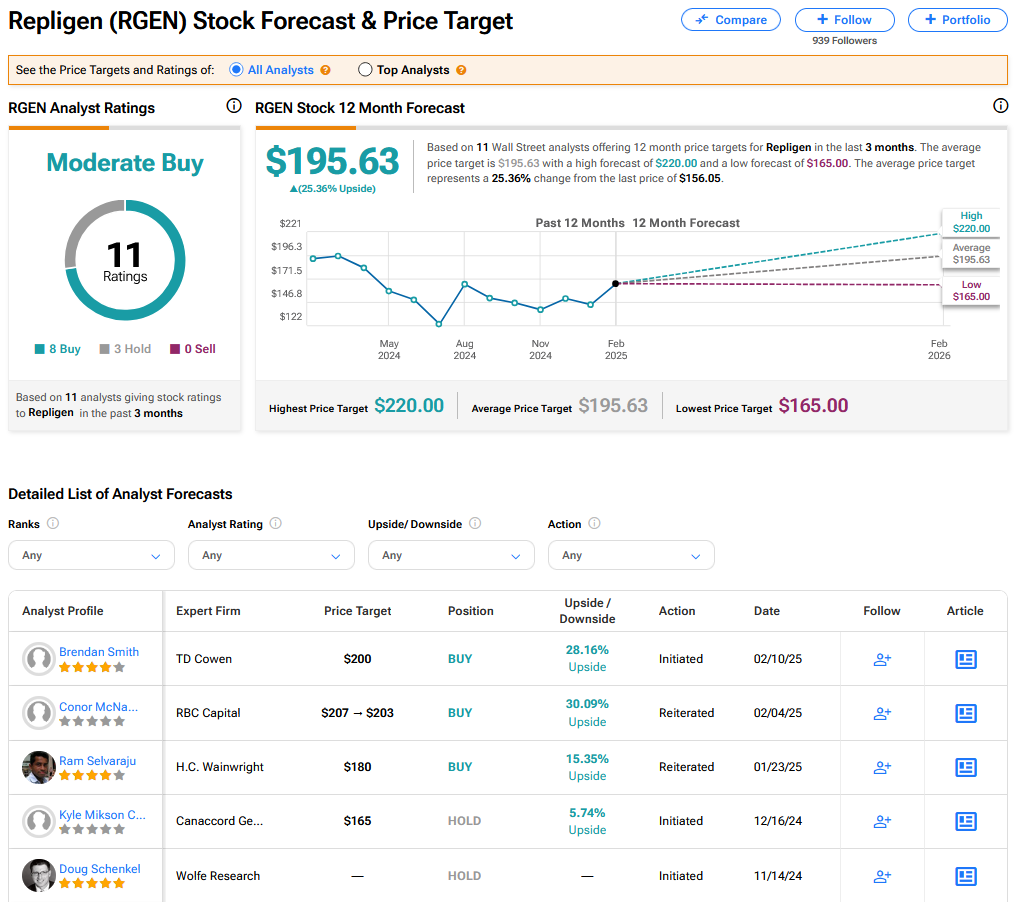

On TipRanks, RGEN has a Moderate Buy consensus based on 8 Buy and 3 Hold ratings. Its highest target price is $220. RGEN stock’s consensus price target is $195.63 implying an 25.36% upside.